April 10, 2014

United States Securities and Exchange Commission

Division of Corporate Finance

Washington, D.C. 20549

Attention: Mr. Brian Cascio

RE: SEC letter dated March 18, 2014 to Cemtrex, Inc.

Dear Sir:

This letter is in response to the SEC comment letter referenced above and we respond as follows.

Form 10-K for the fiscal year ended September 30, 2013

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Results of Operations, page 16

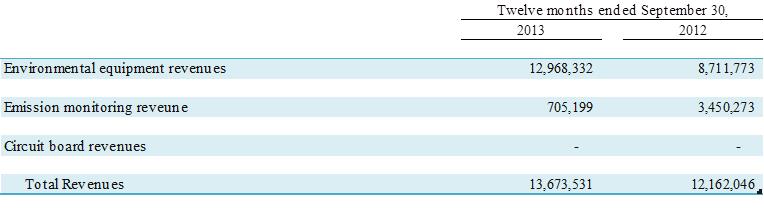

1. We note that you attribute the increase in revenues to a higher amount of bookings and projects executed as well as overall increase in market demand. We also note that you have distinct products in electronic manufacturing services of printed circuit board assemblies, instruments and emission monitors for industrial processes, industrial air filtration and environmental control systems as well as other miscellaneous product lines. Please provide us a break-down of revenues by product types. In future filings provide a discussion of revenues by products types and address the impact of changes in price and quantities sold in the discussion of changes in revenue each period.

Response:

We had no revenues generated from electronic manufacturing services of printed circuit board assemblies during the fiscal years ended September 30, 2013 and 2012. This revenue stream is generated by ROB Group which was acquired on October 31, 2013.

Our revenue breakdown is as follows:

Item 9A. Controls and Procedures, page 18

2. We note that you have not included Management’s Report on Internal Control over Financial Reporting, as required by Item 308 of Regulation S-K although your certifying officers indicate in their certifications that they performed the required evaluation of internal control over financial reporting as of September 30, 2013. Please amend your filing to provide Management’s Report on Internal Controls over Financial Reporting.

Response:

We will amend our filing to include the following paragraphs:

Management's Report on Internal Control Over Financial Reporting

The company's management is responsible for establishing and maintaining adequate "internal control over financial reporting" (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)). Management evaluates the effectiveness of the company's internal control over financial reporting using the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (1992 framework). Management, under the supervision and with the participation of the company's Chief Executive Officer and Chief Financial Officer, assessed the effectiveness of the company's internal control over financial reporting as of September 30, 2013, and concluded that it is effective.

The company's independent registered public accounting firm, Li and Company, PC, has audited the effectiveness of the company's internal control over financial reporting as of September 30, 2013, as stated in their report, which is included herein.

Financial Statements

Note 2. Revenue Recognition, page F-12

3. We note that you are reporting revenue net in accordance with ASC 605-45-45. Please tell us and revise in future filings to clarify which revenue stream you are referring to or if you recognize all revenue on a net basis.

Response:

The inclusion of the paragraph that included the reference to ASC 605-45-45 was an error since our revenue is not recognized on a net basis. Our amended 10-K for the year ended September 31, 2013 will not include this paragraph.

Note 10. Concentrations and Related Party Transactions, page F-16

4. We note that sales in India totaled $10.8 million and $7.3 million in the years ended September 30, 2013 and 2012. We also note that you had no assets in India during this period. Please tell us and clarify in future filings the products sold in India and how you are recognizing the revenues earned on these transactions. Discuss the cost of the products sold and how these are recognized in your financial statements.

Response:

Our sales in India represent the orders received from companies located in India for our environmental control equipment and does not represent products sold in India by our company. We carry out engineering here in the U.S. and then subcontract the entire fabrication to a third party which then fabricates and delivers the equipment as designed by our engineering department to the customer in India. The third party fabricator can be anywhere in the world and is selected based on competitive bidding. Hence we do not require any assets in India to receive and execute such orders.

Form 10-Q for the Quarterly Period ended December 31, 2013

Financial Statements

5. We note that the acquisition of ROB Group completed on October 31, 2013 was significant to your financial statements. Please tell us the significant terms of this acquisition including the purchase price, the assets and liabilities acquired and your accounting for the acquisition. Please also tell us where you have provided the disclosures required by FASB ASC 805-10-50.

Response:

The significant terms of the ROB Group acquisition were included in the 10-K filed January 16, 2014 on page 24 paragraphs 1 and 2 of Item 13.

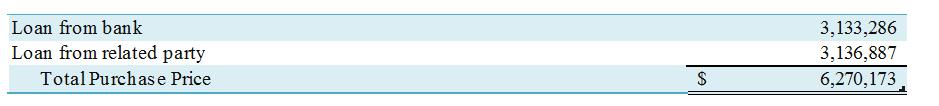

The acquisition date fair value of the total consideration transferred was $6.27 million, which consisted of the following:

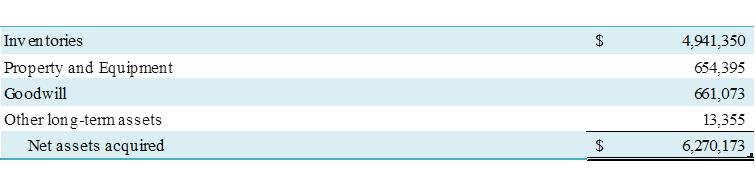

In accordance with Accounting Standards Codification ("ASC") 805, Business Combinations ("ASC 805"), the total purchase consideration is allocated to the net tangible and identifiable intangible assets acquired and liabilities assumed based on their estimated fair values as of October 31, 2013 (the acquisition date). The purchase price was allocated based on the information currently available, and may be adjusted after obtaining more information regarding, among other things, asset valuations, liabilities assumed, and revisions of preliminary estimates.

The following table summarizes the estimated fair values of the assets acquired and liabilities assumed at the acquisition date:

6. Please also tell us your consideration of the requirements of Rule 8-04 and 8-05 of Regulation S-X related to the acquisition of the ROB Group.

Response:

The company filed and 8-K as required by Rule 8-04 and Rule 8-05 of Regulation S-X on November 6, 2013, however, based on recent revelations, that filing may have been inadequate. We are currently working to get that filing amended to include the required disclosures.

7. We also note the discussion on page 8 that you acquired a stake in Pluto Technologies, Inc. on October 30, 2013. Please tell us the significant terms of the acquisition, including the purchase price and the significant assets and liabilities acquired.

Response:

The company has made investments into Pluto Technologies, Inc. (Pluto) in order to potentially expand its product lines. Pluto is engaged in the business of developing applications for mobile devices and is fully owned and operated by Saagar Govil CEO of Cemtrex, Inc. Notes were was issued in the amounts of $80,000 and $274,150 both with terms of 5% per annum, payable in full on October 1, 2015. These notes appear on our Consolidated Balance Sheets under “Prepaid and other current assets”.

Note 3 – Concentrations and Related Party Transactions, page 7

8. We note that sales in the United States increased $1.7 million during the quarter ended December 31, 2013 and sales in Germany totaled $6.8 million, while sales in India decreased to zero. Please tell us where you have disclosed the reasons for these significant changes in revenue during the quarter ended December 31, 2013.

Response:

Please reference the results of operations section on page 13 of our 10-Q for the period ended December 31, 2013, the first paragraph titled ‘Net Sales”.

In addition, sales are subject to fluctuations based on market conditions in any industry. Sales in the United States have increased due to increased industrial production in the United States as it recovers from recession. Business in Germany is due to the acquisition of ROB Group, based in Germany. India has not had any contract for sales for the three months ending December 31, 2013 however, we anticipate having sales in that region for the fiscal year.

Further, please note the Company acknowledges that:

| o | The Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| o | Staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| o | The Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Thank you in advance for your attention to this matter.

Sincerely,

/s/Renato Dela Rama

Renato Dela Rama

Chief Financial Officer

Cemtrex, Inc.