Exhibit 99.1

1 NASDAQ: CETX June 2016

2 Safe Harbor Statement This presentation may contain forward looking statements that involve numerous risks and uncertainties. Actual results could differ materially from those projected in the forward-looking statements as a result of a number of risks and uncertainties. These forward looking statements are not a guarantee of future performance.This release may contain Non-GAAP financial information and are not calculated or presented in accordance with US GAAP. The Company believes that the presentation of non-GAAP financial measures provides useful information to management and investors regarding underlying trends in its consolidated financial condition and results of operations. The Company's management regularly uses these supplemental non-GAAP financial measures internally to understand, manage and evaluate the Company's business and make operating decisions. These risks and uncertainties are discussed in our filings with the Securities and Exchange Commission, including our annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K.Statements made herein are as of the date of this presentation and should not be relied upon as of any subsequent date. Except as may be required by applicable securities laws, we do not undertake any obligation to revise or update any forward-looking statements contained in this release. CETX

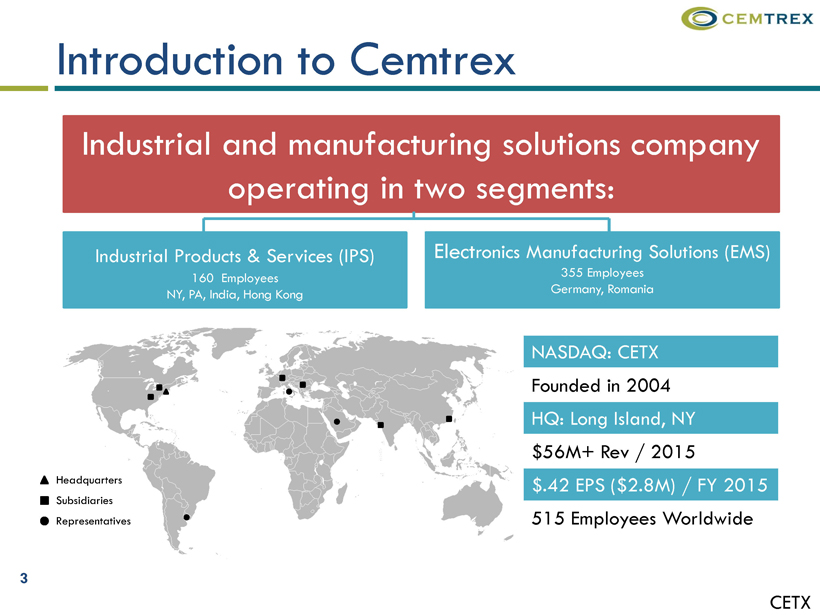

3 Introduction to Cemtrex Headquarters Subsidiaries Representatives Industrial and manufacturing solutions company operating in two segments: Industrial Products & Services (IPS) 160 Employees NY, PA, India, Hong Kong Electronics Manufacturing Solutions (EMS) 355 Employees Germany, Romania NASDAQ: CETX Founded in 2004 HQ: LongIsland, NY $56M+ Rev / 2015 $.42 EPS ($2.8M) / FY 2015 515 Employees Worldwide CETX

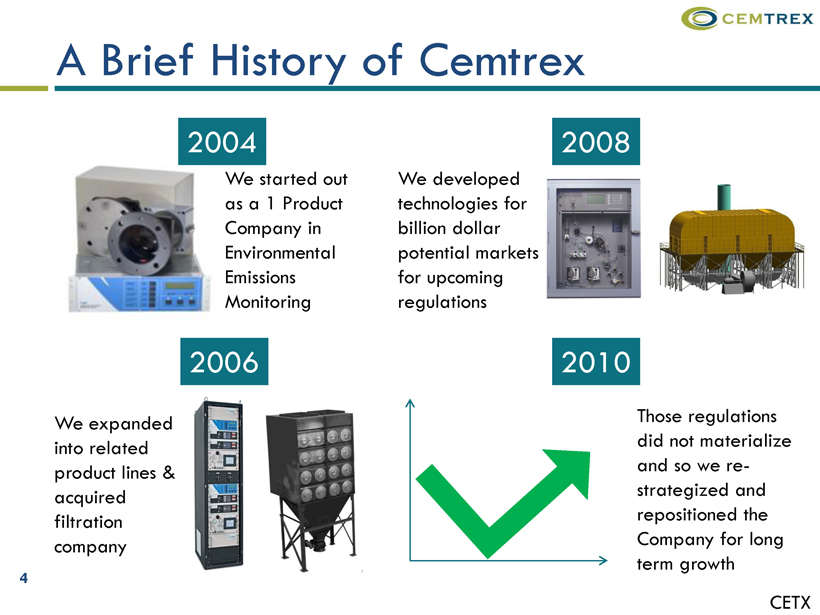

4 A Brief History of Cemtrex 2004 We started out as a 1 Product Company in Environmental Emissions Monitoring 2006 We expanded into related product lines & acquired filtration company 2008 We developed technologies for billion dollar potential markets for upcoming regulations 2010 Those regulations did not materialize and so we re-strategized and repositioned the Company for long term growth CETX

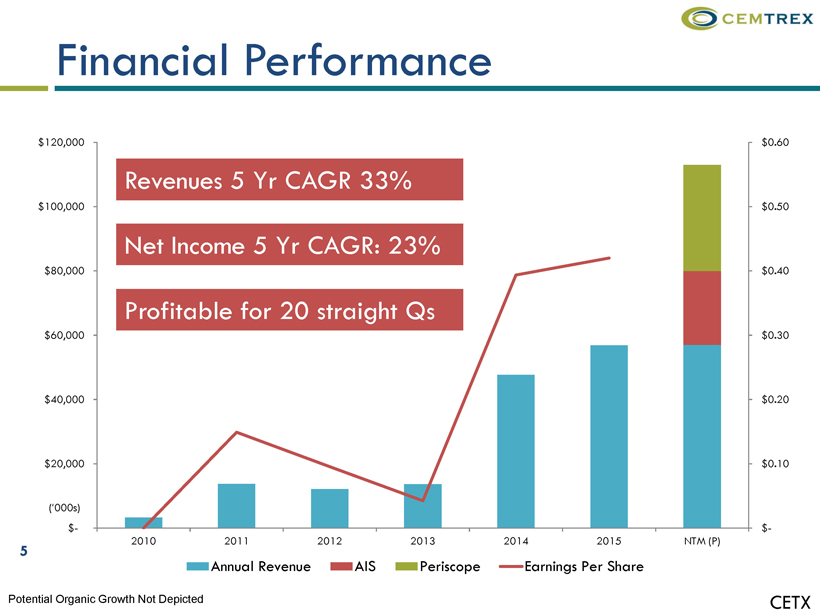

5 Financial Performance $- $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 $- (‘000s) $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 2010 2011 2012 2013 2014 2015 NTM (P) Annual Revenue AIS Periscope Earnings Per Share Revenues 5 YrCAGR 33% Net Income 5 YrCAGR: 23% Profitable for 20 straight Qs Potential Organic Growth Not Depicted CETX

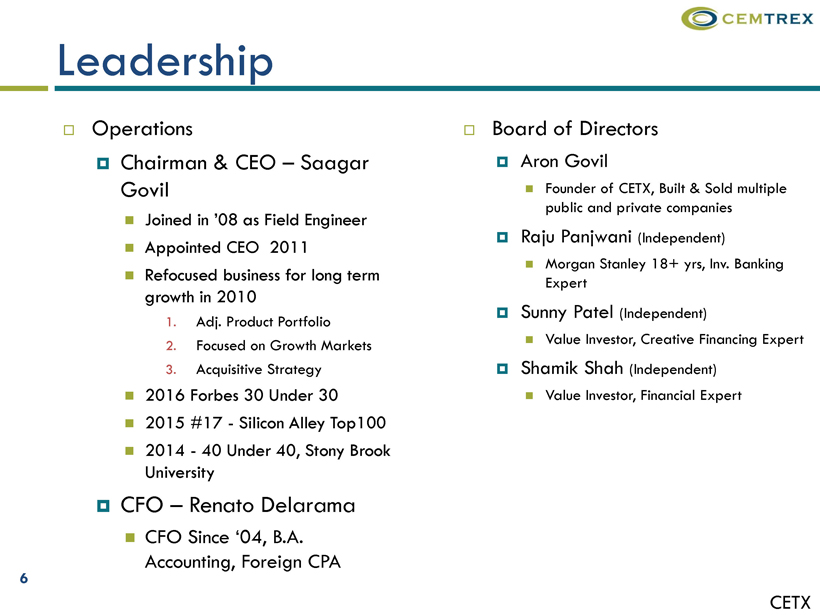

6 Leadership Operations Chairman & CEO –SaagarGovil Joined in ’08 as Field Engineer Appointed CEO 2011 Refocused business for long term growth in 2010 1.Adj. Product Portfolio 2.Focused on Growth Markets 3.Acquisitive Strategy 2016 Forbes 30 Under 30 2015 #17 -Silicon Alley Top100 2014 -40 Under 40, Stony Brook University CFO –Renato Delarama CFO Since ‘04, B.A. Accounting, Foreign CPA Board of Directors Aron Govil Founder of CETX, Built & Sold multiple public and private companies RajuPanjwani(Independent) Morgan Stanley 18+ yrs, Inv. Banking Expert Sunny Patel (Independent) Value Investor, Creative Financing Expert Shamik Shah (Independent) Value Investor, Financial Expert CETX

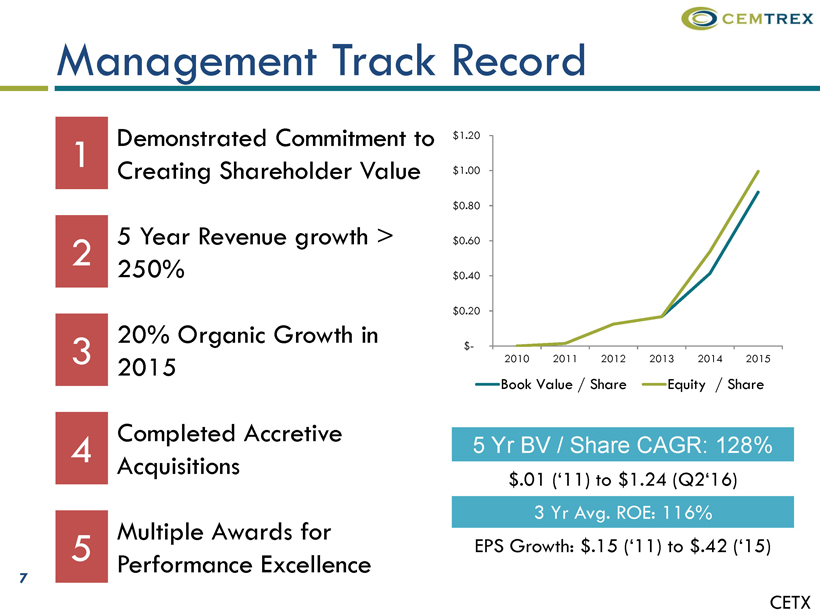

7 Management Track Record $- $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 2010 2011 2012 2013 2014 2015 Book Value / Share Equity / Share 1 Demonstrated Commitment to Creating Shareholder Value 2 5 Year Revenue growth > 250% 3 20% Organic Growth in 2015 4 Completed AccretiveAcquisitions 5 Multiple Awards forPerformanceExcellence CETX

8 Compelling Investment Outlook 1 Rapidly Growing Electronics Market due to IoT(incl. Auto) & Wearables combined with More Outsourcing of Electronics Manufacturing 2 Renewed Global Interest in Curbing GHG & Air Pollution w/ Several Products Mandated by Environmental Regulations 3 Inshoringof Manufacturing and Outsourcing of Industrial Services 4 Marquee Customer Base w/ Product Entrenchment from 15,000 installs w/ Recurring Revenue Component 5 Constantly Working on Completing New Accretive Acquisitions CETX

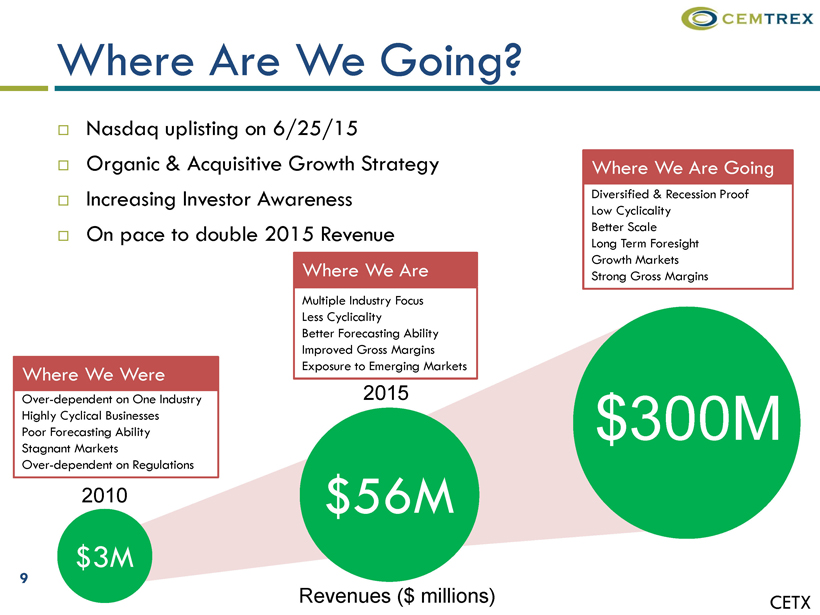

9 Where Are We Going? Nasdaq uplistingon 6/25/15 Organic & Acquisitive Growth Strategy Increasing Investor Awareness On pace to double 2015 Revenue Where We Were Over-dependent on One Industry Highly Cyclical Businesses Poor Forecasting Ability Stagnant Markets Over-dependent on Regulations Where We Are Multiple Industry Focus Less Cyclicality Better Forecasting Ability Improved Gross Margins Exposure to Emerging Markets Where We Are Going Diversified & Recession Proof Low Cyclicality Better Scale Long Term Foresight Growth Markets Strong Gross Margins 2010 $3M 2015 $56M $300M Revenues ($millions) CETX

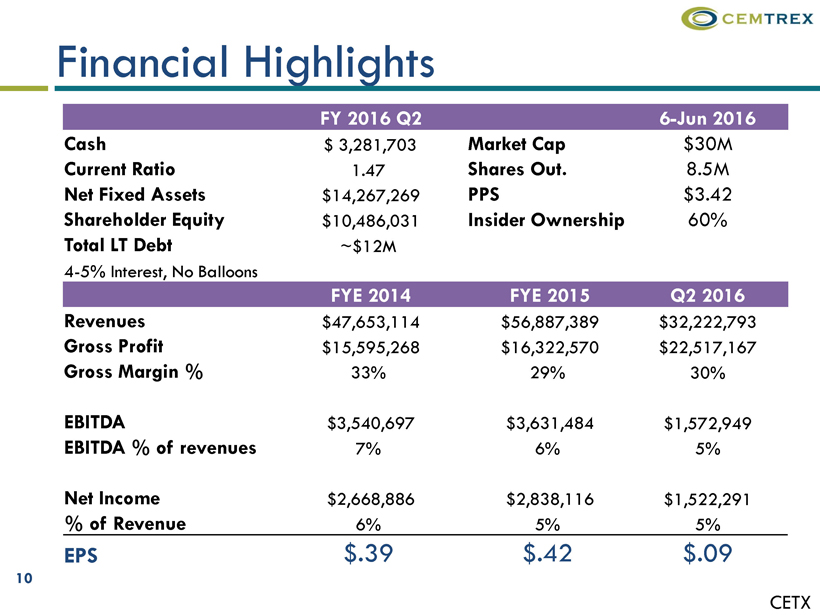

10 Financial Highlights FY2016 Q2 6-Jun 2016 Cash $3,281,703 Market Cap $30M Current Ratio 1.47 Shares Out. 8.5M Net Fixed Assets $14,267,269 PPS $3.42 Shareholder Equity $10,486,031 Insider Ownership 60% Total LT Debt ~$12M 4-5%Interest, No Balloons FYE 2014 FYE 2015 Q22016 Revenues $47,653,114 $56,887,389 $32,222,793 Gross Profit $15,595,268 $16,322,570 $22,517,167 Gross Margin% 33% 29% 30% EBITDA $3,540,697 $3,631,484 $1,572,949 EBITDA% of revenues 7% 6% 5% Net Income $2,668,886 $2,838,116 $1,522,291% of Revenue 6% 5% 5% EPS $.39 $.42 $.09 CETX

11 INDUSTRIAL PRODUCTS & SERVICES Air Filtration, Industrial Products & Services, Analyzers, Instrumentation, Environmental Monitors

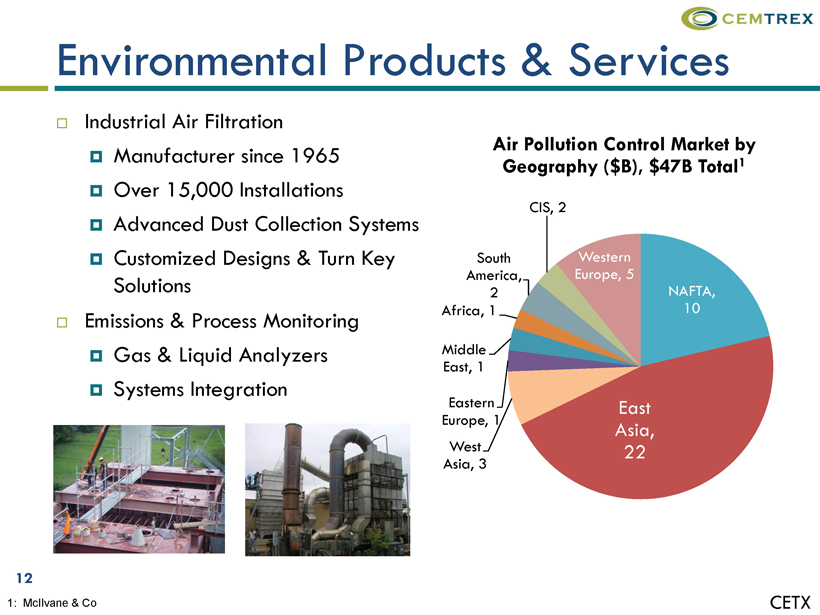

12 Environmental Products & Services Industrial Air Filtration Manufacturer since 1965 Over 15,000 Installations Advanced Dust Collection Systems Customized Designs & Turn Key Solutions Emissions & Process Monitoring Gas & Liquid Analyzers Systems Integration Air Pollution Control Market by Geography ($B), $47B Total1 NAFTA, 10 East Asia, 22 West Asia, 3 Eastern Europe, 1 Middle East, 1 Africa, 1 South America, 2 CIS, 2 Western Europe, 5 1: McIlvane& Co CETX

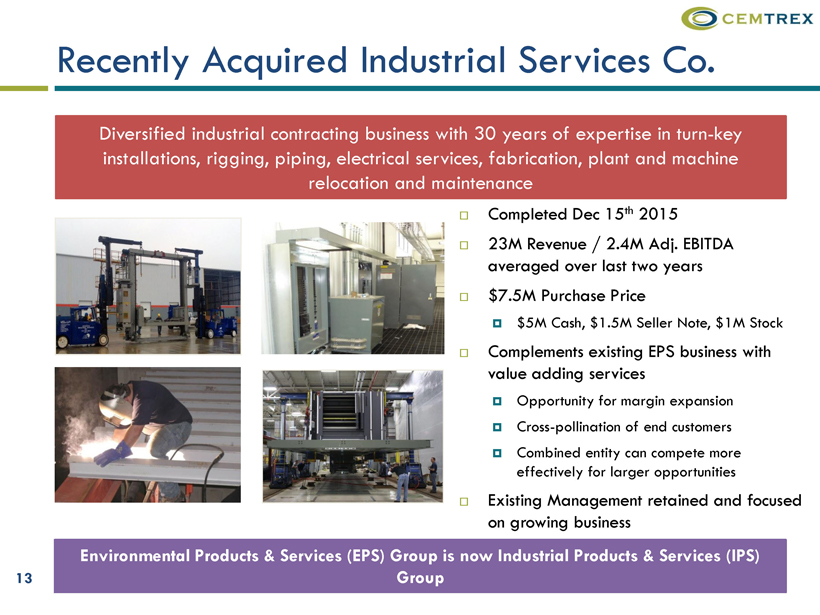

13 Recently Acquired Industrial Services Co. Diversified industrial contracting business with 30 years of expertise in turn-key installations, rigging, piping, electrical services, fabrication, plant and machine relocation and maintenance Completed Dec 15th2015 23M Revenue / 2.4M Adj. EBITDA averaged over last two years $7.5M Purchase Price $5M Cash, $1.5M Seller Note, $1M Stock Complements existing EPS business with value adding services Opportunity for margin expansion Cross-pollination of end customers Combined entity can compete more effectively for larger opportunities Existing Management retained and focused on growing business Environmental Products & Services (EPS) Group is now Industrial Products & Services (IPS) Group

14 Serving Broad Markets with Major Customers: Oil & Gas Engineering & Construction Energy & Utilities Metals, Minerals, Chemicals Food & Agro Industrial & Manufacturing CETX

15 Why Customers Want Our Products & Services Our Competitive Advantages Experienced Management & Engineering Team Over 15,000 Successful Installations Low Price Offerings from Outsourcing Non-core Production Heavy Focus on Custom Designed Solutions (Higher Margins) Superior Product Portfolio to Competitors High Performance & Efficiency Lower Equipment Operating Costs High Repeat Business w/ Product & Service Entrenchment Lower Upfront Costs Reputation as High Quality Supplier CETX

16 Organic Growth Opportunities 1.Emerging Markets WillContinue to Experience Industrial Growth for Decades 1.Sales increased 25% in Asian markets in 2015 2.$5B in New Projects over next 3 years alone1 2.Industrial Services Seeing Increased Demand due to “Inshoring” of Manufacturing back to US 1.Packaging & Material Handling Markets 3.Renewed Global Interest in Curbing Greenhouse Gases 1.GHG Abatement Tech –VAMOX Multi-Billion Dollar Market with Cap & Trade Program 4.New Environmental Regulations World Wide 1.$500M New Market1for monitoring 5.New Product Development Initiatives 6.Exposure to Oil & Gas Boom in US 1: McIlvane& Co; 2 EIA CETX

17 ELECTRONICS MANUFACTURING SERVICES Full Service Electronics & Cabling Solutions Provider

18 Electronics Manufacturing Services We are a Leading Producer of Build to Order Electronic Modules and Systems Manufactured over 300 products for 50+ Customers in 2015 90% of Customers are European OEMs 220,000 SqFt of Manufacturing in Germany 10,000 SqFt of Manufacturing in Romania Entire Product Lifecycle Engineering & Product Design Prototype Creation Contract Manufacturing Cabling & Wire Harnessing Complete Box Builds CETX

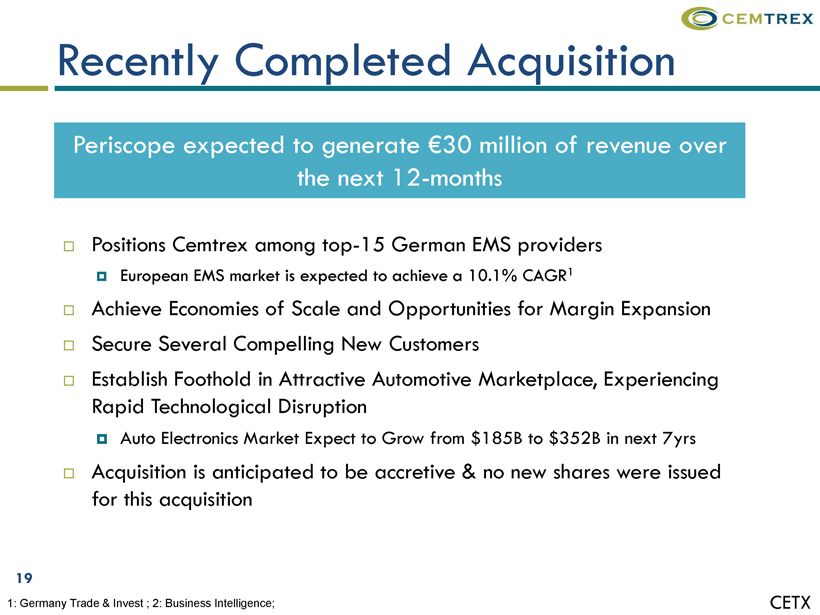

19 Recently Completed Acquisition Periscope expected to generate €30 million of revenue over the next 12-months Positions Cemtrexamong top-15 German EMS providers European EMS market is expected to achieve a 10.1% CAGR1 Achieve Economies of Scale and Opportunities for Margin Expansion Secure Several Compelling New Customers Establish Foothold in Attractive Automotive Marketplace, Experiencing Rapid Technological Disruption Auto Electronics Market Expect to Grow from $185B to $352B in next 7yrs Acquisition is anticipated to be accretive & no new shares were issued for this acquisition 1: Germany Trade & Invest ; 2: Business Intelligence; CETX

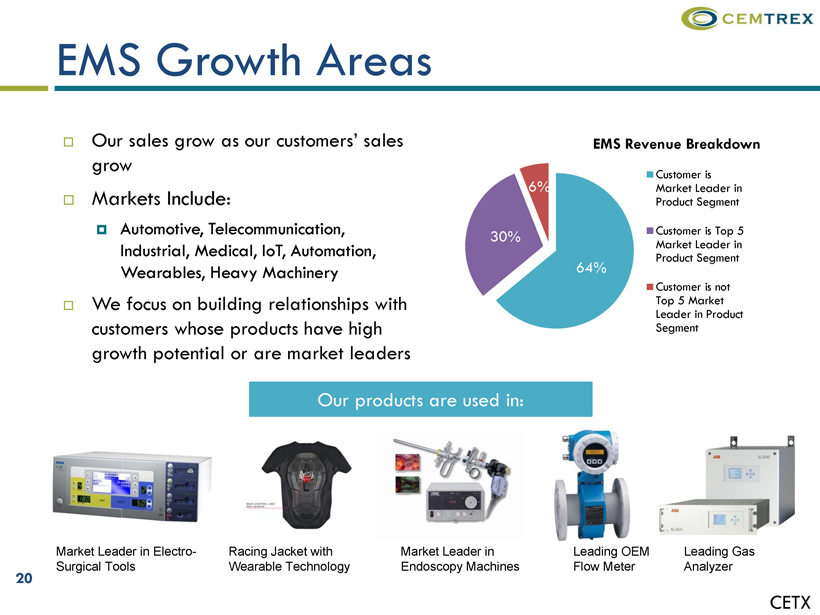

20 EMS Growth Areas Our sales grow as our customers’ sales grow Markets Include: Automotive, Telecommunication, Industrial, Medical, IoT, Automation, Wearables, Heavy Machinery We focus on building relationships with customers whose products have high growth potential or are market leaders 64% 30% 6% EMS Revenue Breakdown Customer isMarket Leader inProduct Segment Customer is Top 5Market Leader inProduct Segment Customer is notTop 5 MarketLeader in ProductSegment Our products are used in: Leading OEM Flow Meter Leading Gas Analyzer Market Leader in Electro-Surgical Tools Market Leader in Endoscopy Machines Racing Jacket with Wearable Technology CETX

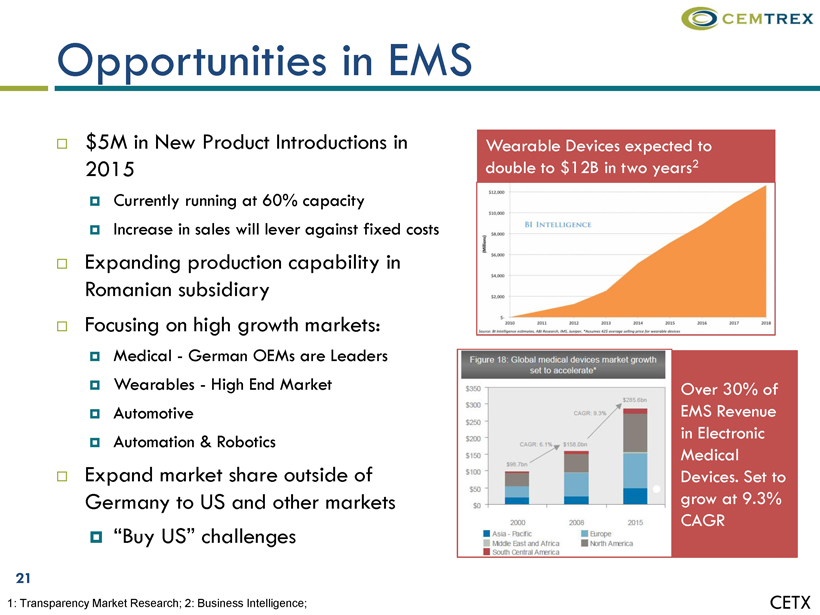

21 Opportunities in EMS $5M in New Product Introductions in 2015 Currently running at 60% capacity Increase in sales will lever against fixed costs Expanding production capability in Romanian subsidiary Focusing on high growth markets: Medical -German OEMs are Leaders Wearables -High End Market Automotive Automation & Robotics Expand market share outside of Germany to US and other markets “Buy US” challenges Wearable Devices expected to double to $12B in two years2 Over 30% of EMS Revenue in Electronic Medical Devices. Set to grow at 9.3% CAGR 1: Transparency Market Research; 2: Business Intelligence; CETX

22 Why Customers Want Our Services Our Competitive Advantages Experienced Management Team Strong Engineering Design Talent Full Service EMS Provider Low Cost Manufacturing Plant in Romania Numerous Supplier Excellence Awards Reputation as High Quality Supplier Most Competitive Prices Able to Deliver Cutting Edge Products One Stop Shop for All Electronic Needs Proven 25YR History of Performance CETX

23 Smart Acquisitions to Increase Growth Completed 3 Transformative Deals in last 3 years and expect to continue with more Constantly exploring strategic acquisition opportunities & partnerships Region Domestically Internationally Technology & Product base Vertical Integration New Innovative Measurement Technologies Leveraging & Diversification of and within customer base The Right Deal Can Come at Any Time CETX

24 CETX -Outlook 1. Many opportunities for catalytic growth at top and bottom lines across all business segments 2. Constantly evaluating acquisition opportunities Successful Track Record of value creating deals The next deal can come along at any time 3. Planned IR Initiatives 4. Long Term Growth Markets 5. Diversified revenue By Region By Industry By Demand Driver Management has demonstrated a commitment to building shareholder value CETX

25 CETX -Thank You CemtrexInc. 19 Engineers Lane, Farmingdale, NY 11735 +1 631-756-9116 www.cemtrex.com investors@cemtrex.com

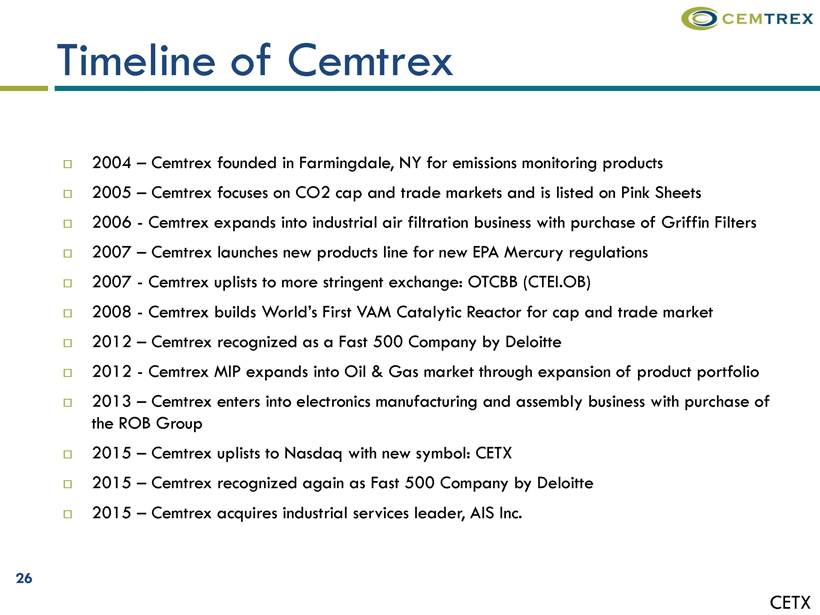

26 Timeline of Cemtrex 2004 –Cemtrex founded in Farmingdale, NY for emissions monitoring products 2005 –Cemtrex focuses on CO2 cap and trade markets and is listed on Pink Sheets 2006 -Cemtrex expands into industrial air filtration business with purchase of Griffin Filters 2007 –Cemtrex launches new products line for new EPA Mercury regulations 2007 -Cemtrex upliststo more stringent exchange: OTCBB (CTEI.OB) 2008 -Cemtrex builds World’s First VAM Catalytic Reactor for cap and trade market 2012 –Cemtrex recognized as a Fast 500 Company by Deloitte 2012 -Cemtrex MIP expands into Oil & Gas market through expansion of product portfolio 2013 –Cemtrex enters into electronics manufacturing and assembly business with purchase of the ROB Group 2015 –Cemtrex upliststo Nasdaqwith new symbol: CETX 2015 –Cemtrex recognized again as Fast 500 Company by Deloitte 2015 –Cemtrex acquires industrial services leader, AIS Inc. CETX