UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant | ☒ |

| Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Rule14a-12 |

CEMTREX INC

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 240.0-11 and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| 1) | Amount Previously Paid: | |

| 2) | Form, Schedule or Registration Statement No.: | |

| 3) | Filing Party: | |

| 4) | Date Filed: |

CEMTREX, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Friday September 30, 2022

To the Shareholders of CEMTREX, INC.:

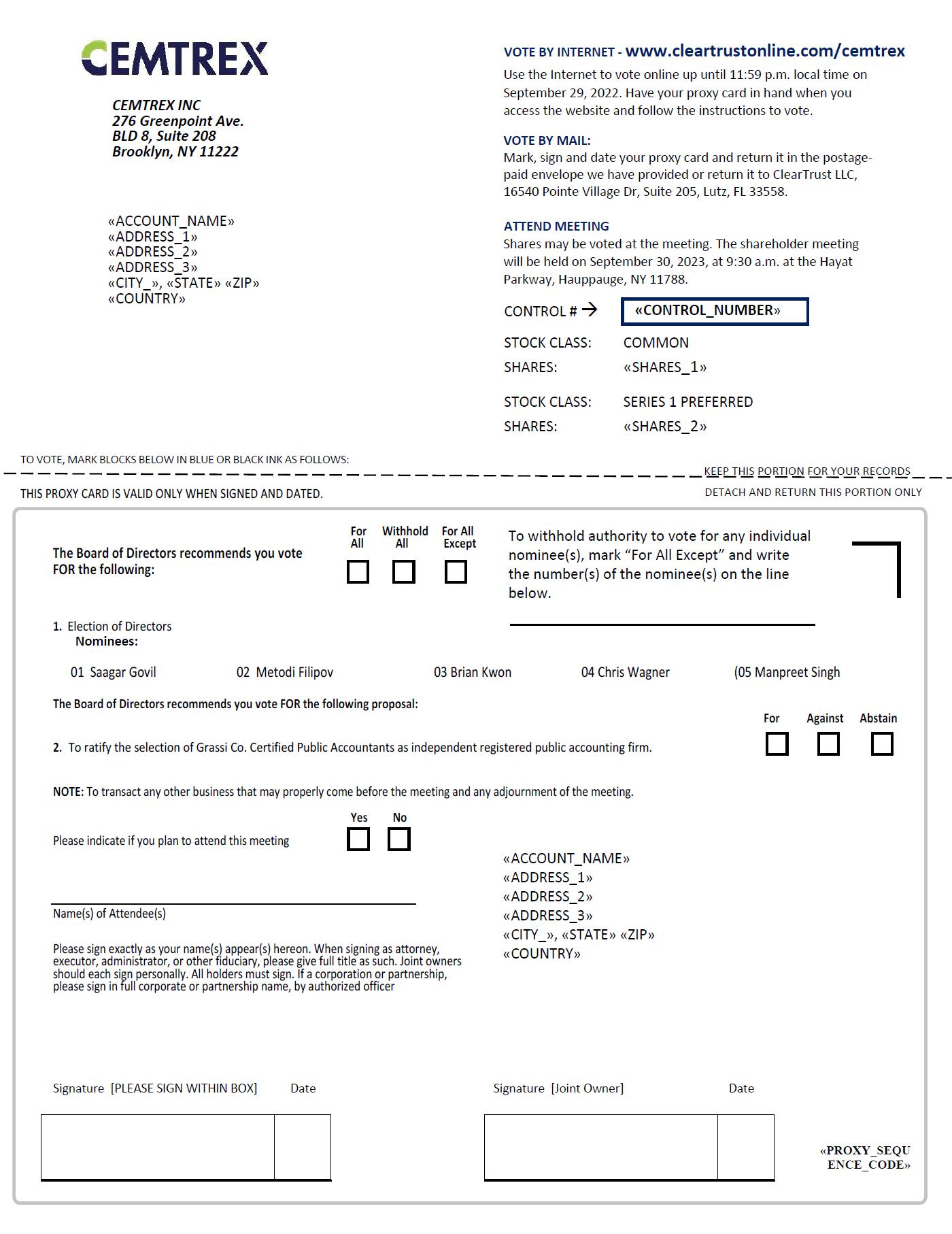

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders (the “Annual Meeting”) of CEMTREX, INC., a Delaware corporation (the “Company”), will be held at the Hyatt Regency Long Island, 1717 Motor Parkway, Hauppauge, NY 11788, on Friday September 30, 2022, at 9:30 a.m., or at any adjournment thereof, for the following purposes:

| 1. | To elect five directors to the Board of Directors; | |

| 2. | To ratify the selection of Grassi Co. Certified Public Accountants as the Company’s independent registered public accounting firm; and | |

| 3. | To consider and act upon such other business as may properly come before the Annual Meeting or any adjournment thereof. |

The above matters are set forth in the Proxy Statement attached to this Notice to which your attention is directed.

Only shareholders of record on the books of the Company at the close of business on August 17, 2022, will be entitled to vote at the Annual Meeting or at any adjournment thereof. You are requested to sign, date and return the enclosed Proxy at your earliest convenience in order that your shares may be voted for you as specified.

| By | Order of the Board of Directors, | |

| Paul J. Wyckoff | ||

| Interim Chief Financial Officer, Cemtrex, Inc. | ||

Important Notice Regarding Internet Availability of Proxy Materials

for the Annual Meeting to Be Held on Friday September 30, 2022:

The proxy materials for the Annual Meeting, including the Annual Report

and the Proxy Statement, are available at cleartrustonline.com/cemtrex.

| Dated: | August 17, 2022 | |

| Brooklyn, New York |

| 2 |

CEMTREX INC.

276 Greenpoint Ave BLD 8 Suite 208

Brooklyn, New York 11222

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

Friday September 30, 2022

The Annual Meeting of Shareholders (the “Annual Meeting”) of CEMTREX INC. (the “Company”) will be held on Friday September 30, 2022, at the Hyatt Regency Long Island, 1717 Motor Parkway, Hauppauge, NY 11788, at 9:30 a.m. for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. The enclosed Proxy is solicited by and on behalf of the Board of Directors of the Company (“Board of Directors” or “Board”) for use at the Annual Meeting to be held on Friday September 30, 2022, and at any adjournments of such Meeting. The approximate date on which this Proxy Statement and the enclosed Proxy are being first mailed to shareholders is September 1, 2022.

If a Proxy in the accompanying form is duly executed and returned, the shares represented by such Proxy will be voted as specified. In the absence of such directions, the Proxy will be voted in accordance with the recommendations of management. Any person executing a Proxy may revoke it prior to its exercise either by letter directed to the Company or in person at the Annual Meeting.

Outstanding Shares

On August 17, 2022 (the “Record Date”), the Company had outstanding 26,413,296 shares of its common stock, par value $0.001 per share (the “Common Stock”). Shareholders are entitled to one vote for each share of

Pursuant to the certificate of designation relating to the Series C Preferred Stock, each issued and outstanding share of Series C Preferred Stock is entitled to the number of votes equal to the result of (i) the total number of shares of Common Stock outstanding at the time of such vote multiplied by 10.01, and divided by (ii) the total number of shares of Series C Preferred Stock outstanding at the time of such vote, at each meeting of our shareholders with respect to any and all matters presented to our shareholders for their action or consideration, including the election of directors. At the Record Date, there were 50,000 shares of Series C Preferred Stock issued and outstanding. Accordingly, each outstanding share of Series C Preferred Stock is currently entitled to 5,287.94186 votes per share or an aggregate of 264,397,093, votes.

Pursuant to the certificate of designation for the Series 1 Preferred Stock, each share of Series 1 Preferred Stock is entitled to two votes per share. At the Record Date, the Company had 2,079,122 shares of Series 1 Preferred Stock issued and 2,015,022 outstanding, or an aggregate of 4,030,044 votes.

Voting Rights

Proposal 1: Election of Directors. Directors of the Company are elected by a plurality of the votes cast in contested and uncontested elections. The election at the Annual Meeting will be uncontested. “Plurality” means that the five individuals who receive the highest number of “FOR” votes will be elected as directors. You may vote either “FOR” or “WITHHOLD” your vote from any one or more of the nominees. Proxy cards specifying that votes should be withheld with respect to one or more nominees will result in those nominees receiving fewer votes but will not count as a vote against the nominees. If you do not instruct your broker how to vote with respect to this item, your broker may not vote your shares with respect to the election of directors. Any shares not voted by a customer will be treated as broker non-votes, and broker non-votes will have no effect on the results of the election of directors.

| 3 |

Proposal 2: Ratification of Independent Registered Public Accounting Firm. To be approved, this proposal to ratify our selection of an independent registered public accounting firm must receive an affirmative vote from shareholders present in person or represented by proxy at the annual meeting representing a majority of the votes cast on the proposal. Abstentions will have no effect on the results of this vote. For this proposal, brokerage firms have authority to vote shares of their customers that are held in “street name.” If a broker does not exercise this authority, the resulting broker non-votes will have no effect on the outcome of this proposal.

Can I vote if my shares are held in “street name”?

If the shares you own are held in “street name” by a brokerage firm, your brokerage firm, as the record holder of your shares, is required to vote your shares according to your instructions. In order to vote your shares, you will need to follow the directions your brokerage firm provides you. Many brokers also offer the option of voting over the Internet or by telephone, instructions for which would be provided by your brokerage firm on your vote instruction form.

Will my shares be voted if I do not provide my proxy?

Under applicable rules, if you do not give instructions to your brokerage firm, it will still be able to vote your shares with respect to certain “discretionary” items, but it will not be allowed to vote your shares with respect to certain “non-discretionary” items. The ratification of Grassi Co. Certified Public Accountants (“Grassi”) as our independent registered public accounting firm (Proposal 2) is considered to be a discretionary item under applicable rules and your brokerage firm will be able to vote on that item even if it does not receive instructions from you, so long as it holds your shares in its name. The remaining items of business at the Annual Meeting are “non-discretionary” and if you do not instruct your broker how to vote with respect to such proposals, your broker may not vote with respect to these proposals and those votes will be counted as “broker non-votes.” “Broker non-votes” are shares that are held in “street name” by a bank or brokerage firm that indicates on its proxy that it does not have or did not exercise discretionary authority to vote on a particular matter. Please see “Voting Rights” for information regarding the vote required to approve the matters being considered at the Annual Meeting and the treatment of broker non-votes.

If you hold your shares directly in your own name, they will not be voted if you do not provide a proxy.

If your shares are held in street name, you must bring an account statement or letter from your bank or brokerage firm showing that you are the beneficial owner of the shares as of the Record Date in order to be admitted to the Annual Meeting. To be able to vote your shares held in street name at the Annual Meeting, you will need to obtain a proxy card from the holder of record.

Can I change my mind after I vote?

Yes, you may revoke your proxy and change your vote at any time before the polls close at the Annual Meeting. You can do this by (1) signing another proxy with a later date and returning it to us prior to the Annual Meeting, or (2) voting again at the Annual Meeting.

What if I return my proxy card but do not include voting instructions?

Proxy cards that are signed and returned but do not include voting instructions will be voted in favor of the election of all of the nominee directors recommended by the Board of Directors, and “FOR” the ratification of the appointment of Grassi.

How will votes be counted?

Each share of Common Stock will be counted as one vote according to the instructions contained on a proper proxy card, whether submitted in person, by mail, on a ballot voted in person at the meeting or in accordance with the instructions provided by your broker. As described under “Outstanding Shares,” each share of Series C Preferred Stock is entitled to 5,287,94186 votes (or 264,397,093 votes in the aggregate), and each share of Series 1 Preferred Stock is entitled to 2 votes (or 4,030,044 votes in the aggregate). With respect to all proposals, shares will not be voted in favor of the matter and will not be counted as voting on the matter, if they are broker non-votes. Assuming the presence of a quorum, abstentions and broker non-votes for a particular proposal will not be counted as votes cast to determine the outcome of a particular proposal.

| 4 |

Will my vote be kept confidential?

Yes, your vote will be kept confidential, and we will not disclose your vote, unless we are required to do so by law (including in connection with the pursuit or defense of a legal or administrative action or proceeding). The inspector of elections will forward any written comments that you make on the proxy card to management without providing your name unless you expressly request disclosure on your proxy card.

How does the Board of Directors recommend that I vote on the proposals?

The Board of Directors recommends that you vote on the proxy card:

“FOR” the election of each of the five nominees, Saagar Govil, Metodi Filipov, Brian Kwon, Chris Wagner, and Manpreet Singh proposed by the Board of Directors to serve as directors, each for a term of one year or until Cemtrex’s 2022 Annual Meeting of Stockholders (Proposal 1);

“FOR” the ratification of the selection of Grassi as our independent registered public accounting firm for the 2022 fiscal year (Proposal 2).

Where can I find the voting results?

We will report the voting results in a current report on Form 8-K within four business days after the end of the Annual Meeting.

What are the costs of soliciting these proxies and who will pay?

We will bear the costs of mailing the proxy statement and solicitation of proxies. In addition to solicitations by mail, our directors, officers and regular employees may solicit proxies by telephone, email and personal communication. No additional remuneration will be paid to any director, officer or employee of the Company for such solicitation. We will request brokers, custodians and fiduciaries to forward proxy soliciting material to the owners of shares of our Common Stock that they hold in their names. We will reimburse banks and brokers for their reasonable out-of-pocket expenses incurred in connection with the distribution of our proxy materials. To the extent necessary in order to assure sufficient representation, our officers and regular employees may request the return of proxies personally, by telephone or email. The extent to which this will be necessary depends entirely upon how promptly proxies are received, and shareholders are urged to send in their proxies without delay.

| 5 |

HOUSEHOLDING OF ANNUAL MEETING MATERIALS

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of our proxy statement and annual report to shareholders may have been sent to multiple shareholders in your household unless we have received contrary instructions from one or more shareholders. We will promptly deliver a separate copy of either document to you if you contact us at the following address or telephone number: Cemtrex, Inc., 276 Greenpoint Ave. BLD 8 Suite 208, Brooklyn, New York 11222, telephone: (631) 756-9116. If you want to receive separate copies of the proxy statement or annual report to shareholders in the future, or if you are receiving multiple copies and would like to receive only one copy per household, you should contact your bank, broker, or other nominee record holder, or you may contact us at the above address or telephone number.

Under the Delaware General Corporation Law, shareholders are not entitled to dissenters’ rights with respect to the proposals set forth in this Proxy Statement.

| 6 |

SECURITY OWNERSHIP

The following table sets forth certain information known to us with respect to the beneficial ownership of our common stock as of August 17, 2022, by:

| ● | all persons who are beneficial owners of five percent (5%) or more of our common stock; | |

| ● | each of our directors; | |

| ● | each of our executive officers; and | |

| ● | all current directors and executive officers as a group. |

Except as otherwise indicated, and subject to applicable community property laws, the persons named in the table below have sole voting and investment power with respect to all shares of common stock held by them.

As of August 17, 2022, 26,413,296 shares of Common Stock were issued and outstanding. In addition, there were 50,000 shares of Series C Preferred Stock outstanding which are entitled to vote 264,397,093 shares in the aggregate, all of which is held by Saagar Govil and 2,015,022 shares of Series 1 Preferred Stock outstanding which are entitled to vote 4,030,044 shares in the aggregate. Accordingly, a total of 294,840,433 shares may be voted at the Annual Meeting.

Beneficial ownership is determined in accordance with the rules of the SEC. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of common stock subject to options held by that person that are currently exercisable or exercisable within 60 days of August 17, 2022, are deemed outstanding. Such shares, however, are not deemed as of August 17, 2022, outstanding for the purpose of computing the percentage ownership of any other person.

| 7 |

| Percentage of | ||||||||||||||||

| Name and Address | Issued | Percentage of | ||||||||||||||

| Title of Class | of Beneficial Owner | Title | Amount Owned | Common Stock (1) | voting stock (2) | |||||||||||

| Common Stock | Saagar Govil | Chairman of the Board, | 703,555 | 3 | % | * | ||||||||||

| 276 Greenpoint Avenue, Suite 208 | Chief Executive Officer, | |||||||||||||||

| Brooklyn, NY 11222 | and President | |||||||||||||||

| Preferred Stock | Saagar Govil | Chairman of the Board, | 8,750 | -- | * | |||||||||||

| (Series 1) | 276 Greenpoint Avenue, Suite 208 | Chief Executive Officer, | ||||||||||||||

| Brooklyn, NY 11222 | and President | |||||||||||||||

| Preferred Stock | Saagar Govil | Chairman of the Board, | 50,000 | (3) | -- | 89.7 | % | |||||||||

| (Series C) | 276 Greenpoint Avenue, Suite 208 | Chief Executive Officer, | ||||||||||||||

| Brooklyn, NY 11222 | and President | |||||||||||||||

| Paul J. Wyckoff | Interim Chief Financial | -- | -- | * | ||||||||||||

| 276 Greenpoint Avenue, Suite 208 | Officer | |||||||||||||||

| Brooklyn, NY 11222 | ||||||||||||||||

| Brian Kwon | Director | -- | -- | * | ||||||||||||

| 276 Greenpoint Avenue, Suite 208 | ||||||||||||||||

| Brooklyn, NY 11222 | ||||||||||||||||

| Chris Wagner | -- | -- | * | |||||||||||||

| 276 Greenpoint Avenue, Suite 208 | Director | |||||||||||||||

| Brooklyn, NY 11222 | ||||||||||||||||

| Manpreet Singh | Director | -- | -- | * | ||||||||||||

| 276 Greenpoint Avenue, Suite 208 | ||||||||||||||||

| Brooklyn, NY 11222 | ||||||||||||||||

| Metodi Filipov | Director | -- | -- | * | ||||||||||||

| 276 Greenpoint Avenue, Suite 208 | ||||||||||||||||

| Brooklyn, NY 11222 | ||||||||||||||||

| All directors and executive officers | ||||||||||||||||

| as a group (3 persons) | 762,305 | (4) | 3 | % | 89.7 | % | ||||||||||

| * | Less than one percent of outstanding shares. |

| (1) | Except as otherwise noted herein, the percentage is determined on the basis of 26,413,296 shares of our Common Stock outstanding plus securities deemed outstanding pursuant to Rule 13d-3 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Under Rule 13d-3, a person is deemed to be a beneficial owner of any security owned by certain family members and any security of which that person has the right to acquire beneficial ownership within 60 days, including, without limitation, shares of our common stock subject to currently exercisable options. |

| (2) | This percentage is based on the 26,413,296 shares of our Common Stock outstanding, the 264,937,093 votes that the Series C Preferred Stock is entitled to vote, and the 4,030,044 votes that the Series 1 Preferred Stock is entitled to vote based on 2 votes per share. |

| (3) | Pursuant to the Certificate of Designation of the Series C Preferred Stock, each issued and outstanding share of Series C Preferred Stock are entitled to the number of votes per share equal to the result of (i) the total number of shares of Common Stock outstanding at the time of such vote multiplied by 10.01, and divided by (ii) the total number of shares of Series C Preferred Stock outstanding at the time of such vote, at each meeting of our shareholders with respect to any and all matters presented to our shareholders for their action or consideration, including the election of directors. |

| (4) | Consists of actual amount of Common Stock, Series C, and Series 1 Preferred Stock owned. As described above each share of Series C is entitled to 5,287.94186 votes. Series 1 Preferred Stock is entitled to 2 votes per share. |

***

| 8 |

PROPOSAL ONE

ELECTION OF DIRECTORS

Five directors are to be elected at the Annual Meeting. The term of each director expires at the Annual Meeting, with Saagar Govil, Brian Kwon, Chris Wagner, Manpreet Singh, and Metodi Filipov standing for reelection for a term of one year. The following table contains information regarding all directors and executive officers of the Company:

| Name and Address | Age | Positions and Offices | ||

| Saagar Govil | 36 | Chairman of the Board of Directors,President, | ||

| 276 Greenpoint Avenue, Suite 208 | Chief Executive Officer, & Director | |||

| Brooklyn, NY 11222 | ||||

| Paul J. Wyckoff | 53 | Interim Chief Financial Officer | ||

| 276 Greenpoint Avenue, Suite 208 | ||||

| Brooklyn, NY 11222 | ||||

| Brian Kwon | 35 | Director | ||

| 276 Greenpoint Avenue, Suite 208 | ||||

| Brooklyn, NY 11222 | ||||

| Chris Wagner | 61 | Director | ||

| 276 Greenpoint Avenue, Suite 208 | ||||

| Brooklyn, NY 11222 | ||||

| Manpreet Singh | 38 | Director | ||

| 276 Greenpoint Avenue, Suite 208 | ||||

| Brooklyn, NY 11222 | ||||

| Metodi Filipov | 58 | Director | ||

| 276 Greenpoint Avenue, Suite 208 | ||||

| Brooklyn, NY 11222 |

Principal Occupations and Business Experience of Directors and Executive Officers

The following is a brief account of the business experience of the Company’s directors and Executive Officers:

Saagar Govil is the Company’s Chairman since June 2014, and the Chief Executive Officer and President since December 2011. He has been working at Cemtrex since 2008, initially as a field engineer, subsequently moving into sales, and management roles as Vice President of Operations. Saagar was recently recognized as a Forbes’ 30 Under 30 in 2016, Business Insiders #17 on Top 100 of Silicon Alley in 2015, and Top 40 Under 40 by Stony Brook University in 2014. Saagar Govil has a B.E. in Materials Engineering from Stony Brook University, N.Y.

| 9 |

Paul J. Wyckoff was appointed Cemtrex’s Interim Chief Financial Officer on January 28, 2021, where he is responsible for the Company’s financial planning, accounting, tax, and business process functions. Mr. Wyckoff has been with Cemtrex since March of 2014 when he joined as the Manager of Financial Reporting and since January of 2019 has served as the Company’s Corporate Controller. Prior to joining Cemtrex, Mr. Wyckoff was the Controller at Vaso Corporation (formerly Vasomedical, Inc.) a medical device distribution company based in Plainview, NY. Mr. Wyckoff has nearly 20 years of private accounting experience and holds a B.S. in Accounting from SUNY College at Old Westbury.

Brian Kwon was appointed to the as a director on September 28, 2021 and is presently the President and Chief Procurement Officer of H Mart. Brian has extensive operations experience in purchasing, distribution, logistics, IT, HR, and e-commerce from his time at H-Mart. Brian has completed the Harvard Business School General Management Program.

Manpreet Singh was appointed as a director on November 1, 2021 and is currently the founder and Chief Investment Officer of Singh Capital Partners (SCP), a multifamily office that directs investments into venture capital, real estate, and growth equity. SCP invests capital on behalf of Fortune 500 CXOs, Unicorn founders and operators and has executed investments in North America, Europe and Asia. He serves on the numerous non-profit and private company boards including AcquCo, US Inspect, Embrace Software, Snowball Industries, Shukr Investments, Suburban Hospital (John Hopkins Medicine) and Dingman Center at the Smith School of Business. He is a CFA charterholder and Manpreet received his MBA from the Wharton School of Business in Entrepreneurship, Finance, and Real Estate. He also holds a B.S. in Finance with a citation in Entrepreneurship from the University of Maryland, College Park. Mr. Singh’s extensive knowledge of finance allow him to make valuable contributions to the Board.

Chris Wagner was appointed as a director on November 3, 2021 and is a technology expert who partners with investors, executives, and entrepreneurs to grow their professional brands, revenues, and customers. Chris is currently a Managing Partner at OTT Advisors. Prior to joining OTT, he co-founded internet start-up NeuLion and helped grow the business to $100 million dollars, which sold to Endeavor for $250 million in cash. After spending more than a decade in the video internet streaming industry, Mr. Wagner has developed an uncanny ability to start-up new technology businesses and enhance existing enterprises through digitally enabled services. Mr. Wagner holds a bachelor’s degree in communications and business administration from the University of Delaware. Mr. Wagner’s extensive knowledge of finance allow him to make valuable contributions to the Board.

Metodi Filipov was appointed to the Board on February 9, 2018 and is an entrepreneur and technology executive with over 25 years of experience creating, operating and driving growth for technology companies. He has a proven track record of identifying business opportunities and building compelling products. Metodi was formerly VP of Operations at Cemtrex from 2008 to 2010. After Cemtrex, Mr. Filipov served as Managing Director of Bianor, a mobile consulting company providing solutions for enterprise clients. There, he led the development and implementation of innovative mobile products in industries including aviation, pharmaceutical and entertainment. Metodi co-founded Flipps Media, an OTT video distribution platform positioned to be an alternative to traditional cable pay-per-view systems. Before Bianor, he served as product lead for Raritan, a data center technology organization, where he was an integral part of the transition team that led the company to becoming a global IT service management solutions provider. Prior to joining Raritan, Mr. Filipov served as VP of Operations at ISS, a security products company. There, he successfully managed product development and contract manufacturing across continents. Mr. Filipov has extensive experience delivering superior solutions with a focus on optimized efficiency and productivity.

Each director of the Company serves for a term of one year or until the successor is elected at the Company’s annual shareholders’ meeting and is qualified, subject to removal by the Company’s shareholders. Each officer serves at the pleasure of the board of directors or according to the terms of his or her employment agreement.

Meetings of the Board of Directors

During the fiscal year ended September 30, 2021 (“Fiscal 2021”), the Board of Directors held four meetings. No Director attended less than 75% of the aggregate of the total number of meetings of the Board of Directors.

| 10 |

Involvement in Certain Legal Proceedings

During the past 10 years, other than as set forth below, none of our current directors, nominees for directors or current executive officers has been involved in any legal proceeding identified in Item 401(f) of Regulation S-K, including:

1. Any petition under the Federal bankruptcy laws or any state insolvency law filed by or against, or a receiver, fiscal agent or similar officer was appointed by a court for the business or property of such person, or any partnership in which he or she was a general partner at or within two years before the time of such filing, or any corporation or business association of which he or she was an executive officer at or within two years before the time of such filing;

2. Any conviction in a criminal proceeding or being named a subject of a pending criminal proceeding (excluding traffic violations and other minor offenses);

3. Being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him or her from, or otherwise limiting, the following activities:

i. Acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, any other person regulated by the Commodity Futures Trading Commission, or an associated person of any of the foregoing, or as an investment adviser, underwriter, broker or dealer in securities, or as an affiliated person, director or employee of any investment company, bank, savings and loan association or insurance company, or engaging in or continuing any conduct or practice in connection with such activity;

ii. Engaging in any type of business practice; or

iii. Engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of Federal or State securities laws or Federal commodities laws;

4. Being subject to any order, judgment or decree, not subsequently reversed, suspended or vacated, of any Federal or State authority barring, suspending or otherwise limiting for more than 60 days the right of such person to engage in any type of business regulated by the Commodity Futures Trading Commission, securities, investment, insurance or banking activities, or to be associated with persons engaged in any such activity;

5. Being found by a court of competent jurisdiction in a civil action or by the SEC to have violated any Federal or State securities law, and the judgment in such civil action or finding by the Commission has not been subsequently reversed, suspended, or vacated;

6. Being found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any Federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated;

7. Being subject to, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of:

i. Any Federal or State securities or commodities law or regulation; or

ii. Any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or

iii. Any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or

| 11 |

8. Being subject to, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

Committees of the Board

Our Board of Directors currently has one standing committee: the Audit Committee.

Compensation Committee

As a “Controlled Company” as such term is defined under NASDAQ Listing Rule 5615, the Company is not required to have a Compensation Committee.

Audit Committee

The Audit Committee, which has been established in accordance with requirements of Section 3(a)(58)(A) of the Exchange Act, is comprised of the following independent directors: Metodi Filipov (Chair), Brian Kwon, Chris Wagner and Manpreet Singh. The Board of Directors has determined that each member of the Audit Committee: (i) is independent, (ii) meets the financial literacy requirements of the Nasdaq Rules, and (iii) meets the enhanced independence standards established by the SEC. In addition, the Board has determined that Mr. Filipov qualifies as an “audit committee financial expert” as that term is defined in Item 407(d)(5)(ii) of Regulation S-K promulgated under the Exchange Act by the SEC.

The Audit Committee is primarily concerned with the integrity of our financial statements, the independence, qualifications and performance of our independent registered public accounting firm, and our compliance with legal requirements. The Audit Committee operates under a written charter approved by the Board of Directors and the Audit Committee that reflects standards and requirements adopted by the SEC and NASDAQ.

As indicated in its charter, the Audit Committee’s duties include selecting and engaging our independent registered public accounting firm; reviewing the scope of the audit to be conducted by our independent registered public accounting firm; overseeing our independent registered public accounting firm and reviewing the results of its audit; reviewing our financial reporting processes, including the accounting principles and practices followed and the financial information provided to shareholders and others; overseeing our internal control over financial reporting and disclosure controls and procedures; and serving as our legal compliance committee.

Nomination of Directors

The Company does not currently have a standing nominating committee or a formal nominating committee charter. As a “Controlled Company” as such term is defined by NASDAQ Listing Rule 5615 the Company is not required to have a Nominating Committee. Currently, the independent members of the Board (Messrs. Panjwani, Patel and Filipov), rather than a nominating committee, approve or recommend to the full Board those persons to be nominated. The Board believes that the current method of nominating directors is appropriate because it allows each independent board member input into the nomination process and does not unnecessarily restrict the input that might be provided from an independent director who could be excluded from a committee. Currently, one of the two Directors are independent. Furthermore, the Board has adopted by resolution a director nomination policy. The purpose of the policy is to describe the process by which candidates for inclusion in the Company’s recommended slate of director nominees are selected. The director nomination policy is administered by the Board. Many of the benefits that would otherwise come from a written committee charter are provided by this policy.

In the ordinary course, absent special circumstances or a change in the criteria for Board membership, the incumbent directors who continue to be qualified for Board service and are willing to continue as directors are re-nominated. If the Board thinks it is in the best interest of the Company to nominate a new individual for director in connection with an annual meeting of shareholders, or if a vacancy occurs between annual shareholder meetings, the Board will seek potential candidates for Board appointments who meet the criteria for selection as a nominee and have the specific qualities or skills being sought. Director candidates will be selected based on input from members of the Board, senior management of the Company and, if deemed appropriate, a third-party search firm.

| 12 |

Candidates for Board membership must possess the background, skills and expertise to make significant contributions to the Board, to the Company and its shareholders. Desired qualities to be considered include substantial experience in business or administrative activities; breadth of knowledge about issues affecting the Company; and ability and willingness to contribute special competencies to Board activities.

The Board of Directors intends to review the director nomination policy from time to time to consider whether modifications to the policy may be advisable as the Company’s needs and circumstances evolve, and as applicable legal or listing standards change. The Board may amend the director nomination policy at any time.

The Board will consider director candidates recommended by shareholders and will evaluate such director candidates in the same manner in which it evaluates candidates recommended by other sources, as described above. Recommendations must be in writing and mailed to Cemtrex, Inc., 135 Fell Ct. Hauppauge, New York 11788, Attention: Corporate Secretary, and include all information regarding the candidate as would be required to be included in a proxy statement filed pursuant to the proxy rules promulgated by the SEC if the candidate were nominated by the Board of Directors (including such candidate’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected). The shareholder giving notice must provide (i) his or her name and address, as they appear on the Company’s books, and (ii) the number of shares of the Company which are beneficially owned by such shareholder. The Company may require any proposed nominee to furnish such other information it may require to be set forth in a shareholder’s notice of nomination which pertains to the nominee.

Insider Trading Policy

We recognize that the Company’s executive officers and directors may sell shares from time to time in the open market to realize value to meet financial needs and diversify their holdings, particularly in connection with exercises of stock options. All such transactions are required to comply with the Company’s insider trading policy.

Section 16 (a) Beneficial Ownership Reporting Compliance of the Securities Exchange Act

Section 16(a) of the Exchange Act requires the Company’s executive officers, directors and persons who own more than 10% of a registered class of the Company’s equity securities (“Reporting Persons”) to file reports of ownership and changes in ownership on Forms 3, 4, and 5 with the SEC. These Reporting Persons are required by SEC regulation to furnish the Company with copies of all Forms 3, 4 and 5 they file with the SEC. Based solely upon a review of Forms 3, 4, and 5, furnished to the Company during the fiscal year ended September 30, 2021, and based upon certain other information provided to the Company, the Company believes that all appropriate filings were made on a timely basis.

Communications with Directors

Shareholders, associates of the Company and other interested parties may communicate directly with the Board of Directors, with the non-management Directors or with a specific Board member, by writing to the Board (or the non-management Directors or a specific Board member) and delivering the communication in person or mailing it to: Board of Directors, Privileged & Confidential, c/o Paul J. Wyckoff, Interim Chief Financial Officer, Cemtrex, Inc., 135 Fell Ct. Hauppauge, New York 11788. Correspondence will be discussed at the next scheduled meeting of the Board of Directors, or as indicated by the urgency of the matter. From time to time, the Board of Directors may change the process by which shareholders may communicate with the Board of Directors or its members. Any changes in this process will be posted on the Company’s website or otherwise publicly disclosed.

| 13 |

Corporate Governance

The Company has an ongoing commitment to good governance and business practices. In furtherance of this commitment, we regularly monitor, and are briefed by outside counsel on, developments in the area of corporate governance and securities law and review our policies and procedures in light of such developments. We comply with the rules and regulations promulgated by the SEC and implement other corporate governance practices we believe are in the best interests of the Company and the shareholders.

Code of Ethics

We have adopted a code of ethics as of June 28, 2016, that applies to our principal executive officer, principal financial officer, and principal accounting officer as well as our employees. Our standards are in writing and are posted on our website. The following is a summation of the key points of the Code of Ethics we adopted:

| ● | Honest and ethical conduct, including ethical handling of actual or apparent conflicts of interest between personal and professional relationships; | |

| ● | Full, fair, accurate, timely, and understandable disclosure reports and documents that a small business issuer files with, or submits to, the Commission and in other public communications made by our Company; | |

| ● | Full compliance with applicable government laws, rules and regulations; | |

| ● | The prompt internal reporting of violations of the code to an appropriate person or persons identified in the code; and | |

| ● | Accountability for adherence to the code. |

Board Leadership and Structure

Saagar Govil, our Chief Executive Officer, also serves as Chairman of the Board of Directors. The Board believes that the Company and its shareholders are best served by having the Chief Executive Officer also serve as Chairman of the Board. The Board also believes that this structure is appropriate in light of the size of our Company and corresponding size of our Board and the complexity of our business. We believe that Mr. Govil is best positioned to develop agendas that ensure that our Board’s time and attention are focused on the matters that are most critical to us.

Director Independence

The Board of Directors has determined that each of Messrs. Kwon, Wagner, Singh, and Filipov are independent in accordance with NASDAQ rules. To determine independence, the Board of Directors adopted and applied the categorical standards of independence included in NASDAQ Listing Rule 5605(a)(2), which include a series of objective tests, such as that the director is not an employee of the Company and has not engaged in various types of business dealings with the Company.

Risk Oversight

The Board oversees Company functions in an effort to assure that Company assets are properly safeguarded, that appropriate financial and other controls are maintained, and that the Company’s business is conducted prudently and in compliance with applicable laws, regulations and ethical standards.

While the Board is responsible for risk oversight, Company management is responsible for managing risk. The Company has a robust internal process and a strong internal control environment to identify and manage risks and to communicate with the Board. The Board monitors and evaluates the effectiveness of the internal controls and the risk management program at least annually. Management communicates routinely with the Board and individual Directors on the significant risks identified and how they are being managed. Directors are free to, and often do, communicate directly with senior management.

| 14 |

Board Attendance at Annual Meetings of Shareholders

The Company does not currently have a formal policy regarding Director attendance at the Annual Meeting of Shareholders. It is, however, expected that directors will be in attendance, absent compelling circumstances. Metodi Filipov, Brian Kwon, and Manpreet Singh were not in attendance at last year’s meeting. Chris Wagner was not yet a director at the time of last year’s meeting and was not in attendance.

Transactions with Related Persons

On August 31, 2019, the Company entered into an Asset Purchase Agreement for the sale of Griffin Filters, LLC to Ducon Technologies, Inc., which Aron Govil, the Company’s Founder and former CFO, its President, for total consideration of $550,000. As of June 30, 2022, and September 30, 2021, there was $1,472,514 and $1,487,155 in receivables due from Ducon Technologies, Inc., respectively. At June 30, 2022, $500,000 of the balance due is for the sale of Griffin, which was due in February 2021, and the remaining balance are various receivables with various due dates within the next fiscal year. The Company has negotiated a payment agreement surrounding the sale of Griffin Filters, LLC and other liabilities due to Cemtrex, Inc. totaling 761,585. This agreement is in the form of a secured promissory note earning interest at a rate of 5% per annum and matures on July 31, 2024. The remaining $710,929 represents the amount due from Ducon to Cemtrex Technologies Pvt. Ltd. the Company’s subsidiary based in India and is still in negotiation.

On February 23, 2021, Cemtrex’s Board of Directors determined that certain transactions between Cemtrex Inc. and First Commercial, a company owned by former Executive Director, former Controlling Shareholder and former CFO, Aron Govil, were incorrectly handled and accounted for.

The total amount of disputed transfers was approximately $7,100,000 and occurred in fiscal year 2017 in the amount of $5,600,000 and in fiscal year 2018 in the amount of $1,500,000. Cemtrex did not find any other such transfers during this period or thereafter, upon further review of the Company’s records.

Upon the Company’s investigation into this matter, the Company has determined that there were inaccuracies in the Company’s financial statements. The financials for the periods 2017 and 2018 were incorrect corresponding to the amounts that were incorrectly accounted for, and subsequent years were affected by the roll forward effects of these entries. The Company found unsupported advertising expenses in the amount of approximately $400,000 on Cemtrex Inc’s income statement for fiscal year 2018 and found that approximately $5,700,000 of intangible assets and $975,000 of research and development expenses, as translated from Indian Rupee at the time, were recorded on Cemtrex India’s financial statements in fiscal year 2018 and could not be substantiated. The total amount of unsubstantiated transfers recorded by Cemtrex India, and the unsupported advertising expense recorded by Cemtrex, Inc. sums to $7,100,000, corresponding with the total amount in question regarding First Commercial transfers during fiscal years 2017 and 2018

On February 26, 2021, the Company entered into a Settlement Agreement and Release with Aron Govil regarding these transactions.

As part of the Settlement Agreement, Mr. Govil was required to pay the Company consideration with a total value of $7,100,000 (the “Settlement Amount”) by entering into the Agreement. The Settlement Amount was satisfied in a combination of Mr. Govil forfeiting certain Preferred Stock and outstanding options and executing a secured note in the amount of $1,533,280. The Independent Board of Directors in coordination with Management concluded the settlement represented fair value.

In March 2021, Mr. Govil returned to the Company 1,000,000 shares of Series A Preferred Stock, 50,000 Shares of Series C Preferred Stock, 469,949 shares of Series 1 Preferred Stock, and forfeited all outstanding options to purchase shares of commons stock (collectively, the “Securities”). For the purposes of accounting recognition, the Company determined the fair value of the Series A, Series C, and Series 1 Preferred stock based on the closing trading value of the Series 1 Preferred Stock on the date of the agreement. The options surrendered were valued using the Black-Scholes option pricing model.

The Company recognized the gain with respect to the surrendered Securities during the second quarter of fiscal year 2021. The gain of $3,674,165 is reported as Settlement Agreement – Related Party on the Company’s Condensed Consolidated Statements of Operations and Comprehensive Income/(Loss).

As discussed above, Mr. Govil also executed a secured promissory note (the “Note”) in the amount of $1,533,280. The Note matures and is due in full in two years and bears interest at 9% per annum and is secured by all of Mr. Govil’s assets. Mr. Govil also agreed to sign an affidavit confessing judgment in the event of a default on the Note. While the Company believes the note is fully collectible, in accordance with ASC 450-30, Gain Contingencies, the Company determined the gain will not be recognized until the note is paid. Accordingly, the note and associated gain is not presented on the Company’s Condensed Consolidated Balance Sheets and Condensed Consolidated Statements of Operations and Comprehensive Income/(Loss).

| 15 |

AUDIT COMMITTEE REPORT

Management is responsible for our system of internal controls over financial reporting and for preparing our financial statements. Our independent registered public accounting firm, Grassi, is responsible for performing an independent audit of our consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States) (“PCAOB”) and to issue a report thereon. The Audit Committee is responsible for overseeing management’s conduct of the financial reporting process and system of internal control.

During the fiscal year ended September 30, 2021, the Audit Committee met regularly and held discussions with management and the independent registered public accounting firm. During these meetings and in meetings concerning our Annual Report for the year ended September 30, 2021, the Audit Committee has:

| ● | reviewed and discussed the audited financial statements included in our Annual Report for the year ended September 30, 2021, with management and our independent registered public accounting firm; | |

| ● | received the written disclosures and communications from the independent registered public accounting firm that are required by the applicable requirements of the PCAOB regarding such firm’s communications with the Audit Committee concerning independence and has discussed with such firm its independence; and | |

| ● | discussed with the independent registered public accounting firm the matters required to be discussed under Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1, AU section 380), as adopted by the PCAOB in Rule 3200T, or any successor rule. |

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements of the Company and its subsidiaries be included in the Annual Report for the year ended September 30, 2021, for filing with the SEC.

The Audit Committee has relied, without independent verification, on management’s representation that the financial statements have been prepared with integrity and objectivity and in conformity with accounting principles generally accepted in the United States and on the representations of the independent registered public accounting firm included in its report on our financial statements. The Audit Committee’s considerations and discussions with management and the independent registered public accounting firm do not, however, ensure that our financial statements are presented in accordance with generally accepted accounting principles or that the audit of our financial statements has been carried out in accordance with the standards of the PCAOB.

The information contained in this report shall not be deemed to be “soliciting material” or “filed” or incorporated by reference in future filings with the SEC, or subject to the liabilities of Section 18 of the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates it by reference into a document filed under the Securities Act of 1933, as amended, or the Exchange Act.

MEMBERS OF THE AUDIT COMMITTEE

Metodi Filipov , Chair

Manpreet Singh

Brian Kwon

Chris Wagner

| 16 |

EXECUTIVE COMPENSATION

The compensation discussion addresses all compensation awarded to, earned by, or paid to the Company’s named executive officers (“NEO”), which currently consists of Saagar Govil, the Chairman, Chief Executive Officer, President and Secretary, and Paul J. Wyckoff, Interim CFO. As of August 17, 2022, Saagar Govil and Paul J. Wyckoff are currently earning compensation from the Company. Paul J. Wyckoff was named Interim CFO on January 28, 2022 and is not included in this table. Set forth below is the aggregate compensation for services rendered in all capacities to us during our fiscal years ended September 30, 2020, and 2021 by our executive officers.

| OPTION | ||||||||||||||||||||||||

| PRINCIPAL AND POSITION | YEAR | SALARY | BONUS | AWARDS | OTHER | TOTAL | ||||||||||||||||||

| ($) | ($) | ($) | ($) | ($) | ||||||||||||||||||||

| Saagar Govil | 2021 | 600,000 | 300,000 | - | 31,830 | 300,000 | ||||||||||||||||||

| Chairman od the Board | 2020 | 376,923 | 612,303 | - | 24,439 | 612,303 | ||||||||||||||||||

| Chief Executive Officer, | ||||||||||||||||||||||||

| and President | ||||||||||||||||||||||||

| Christopher C. Moore | 2021 | 137,250 | - | 185,803 | (1) | 7,528 | 185,802 | |||||||||||||||||

| Former Chief Financial Officer | ||||||||||||||||||||||||

| Aron Govil | 2021 | 9,423 | - | |||||||||||||||||||||

| FormerExecutive Director and | 2020 | 276,923 | 243,140 | - | - | 243,140 | ||||||||||||||||||

| Chief Financial Officer | ||||||||||||||||||||||||

| Priscilla Popov | 2021 | 46,500 | - | - | - | - | ||||||||||||||||||

| Former Chief Financial Officer | ||||||||||||||||||||||||

| (1) | The Option Awards Column in the table above reflects the aggregate grant date fair value of the award granted in the year noted. Please see Options/SAR Grants in the Last Fiscal Year below for more information relating to this option grant. |

NARRATIVE TO SUMMARY COMPENSATION TABLE

At this time, we do not have an employment agreement with Saagar Govil or Paul J. Wyckoff, though the Company may enter into such an agreement with them on terms and conditions usual and customary for the industry. All amounts paid to our officers in fiscal year end 2021 were approved by the Company’s board of directors. The Company does not currently have “key man” life insurance on Mr. Govil or Mr. Wyckoff.

OPTIONS/SAR GRANTS IN THE LAST FISCAL YEAR

On January 6, 2021, the Company granted to Christopher C. Moore, the Company’s CFO, a stock option for 150,000 shares. These options have an exercise price of $1.58 per share, which vest over five years, and they expire after five years. These options were cancelled on January 28, 2022, upon Mr. Moore’s departure from the Company.

AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR AND FISCAL YEAR END OPTION/SAR VALUES

None.

| 17 |

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

The following table presents information regarding our NEOs’ unexercised options to purchase Common Stock as of September 30, 2021:

| Option Awards | ||||||||||

| Name | Number of Securities Underlying Unexercised Options Exercisable | Option Exercise Price | Option Expiration Date | |||||||

| Saagar Govil | 400,000 | $ | 1.90 | 2/25/2026 | ||||||

| Saagar Govil | 100,000 | $ | 1.92 | 2/25/2026 | ||||||

| Saagar Govil | 100,000 | $ | 2.30 | 2/25/2026 | ||||||

| Saagar Govil | 100,000 | $ | 2.76 | 2/25/2026 | ||||||

| Chris Moore (1) | 150,000 | $ | 1.58 | 1/5/2026 | ||||||

| (1) | As discussed above, these options were cancelled on January 28, 2022, upon Mr. Moore’s departure from the Company. |

Compensation of Directors

The members of the Board receive quarterly compensation of $2,500. Additionally, we reimburse our directors for expenses incurred in connection with attending board meetings.

| 18 |

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors has selected Grassi Co. Certified Public Accountants to serve as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2022. While shareholder ratification is not required by the Company’s By-laws or otherwise, the Board of Directors is submitting the selection of Grassi Co. Certified Public Accountants. to the shareholders for ratification as part of good corporate governance practices. If the shareholders fail to ratify the selection, the Board of Directors may, but is not required to, reconsider whether to retain Grassi Co. Certified Public Accountants. Even if the selection is ratified, the Board of Directors in its discretion may direct the appointment of a different accounting firm as the independent registered public accounting firm for the Company for the year ending September 30, 2022, at any time during the year if it determines that such a change would be in the best interest of the Company and its shareholders.

The favorable vote of the holders of a majority of the shares of Common Stock and Preferred Stock with voting rights, represented in person or by proxy at the Annual Meeting, will be required for such ratification.

The following table sets forth the aggregate fees billed to the Company for the years ended September 30, 2021 and 2020 by Grassi & CO., CPAs, P.C. and Haynie & Company the Company’s independent auditors during those periods:

| 2020 | 2021 | |||||||

| Audit Fees | $ | 150,000 | $ | 477,313 | ||||

| Audit-Related Fees | 16,098 | 233,357 | ||||||

| Tax Fees | - | - | ||||||

| Other Fees | 16,750 | - | ||||||

| Totals | $ | 182,848 | $ | 710,670 | ||||

For the fiscal year ended September 30, 2020, the company incurred fees for tax services of $67,314, provided by Wiss and Company.

For the fiscal year ended September 30, 2021, the company incurred fees for tax services of $80,099, provided by Wiss and Company.

Pre-Approval Policies and Procedures

The Company’s Audit Committee must provide advance approval for all audit and non-audit services, other than de minimis non-audit services. Before granting any approval, the Audit Committee gives due consideration to whether approval of the proposed service will have a detrimental impact on the independence of the independent registered public accounting firm. The full Audit Committee pre-approved all services provided by Grassi in fiscal year 2021.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE RATIFICATION OF GRASSI AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING SEPTEMBER 30, 2022.

| 19 |

MISCELLANEOUS INFORMATION

As of the date of this Proxy Statement, the Board of Directors does not know of any business other than that specified above to come before the Annual Meeting, but, if any other business does lawfully come before the Annual Meeting, it is the intention of the persons named in the enclosed Proxy to vote in regard thereto in accordance with their judgment.

The Company will pay the cost of soliciting Proxies in the accompanying form and as set forth below. In addition to solicitation by use of the mails, certain officers and regular employees of the Company may solicit proxies by telephone, telegraph or personal interview without additional remuneration therefor.

SHAREHOLDER PROPOSALS

Shareholder proposals with respect to the Company’s next Annual Meeting of Shareholders must be received by the Company no later than December 16, 2022, to be considered for inclusion in the Company’s next proxy statement.

Under SEC proxy rules, proxies solicited by the Board of Directors for the 2022 Annual Meeting may be voted at the discretion of the persons named in such proxies (or their substitutes) with respect to any shareholder proposal not included in the Company’s Proxy Statement if the Company does not receive notice of such proposal on or before December 16, 2022, unless the 2022 Annual Meeting is not held within 30 days before or after the anniversary date of the 2021 Annual Meeting.

A copy of the Company’s Annual Report to Shareholders for the fiscal year ended September 30, 2021, has been provided to all shareholders. Shareholders are referred to the Annual Report for financial and other information about the Company, but such Report is not incorporated in this Proxy Statement and is not part of the proxy soliciting material.

| Dated: | August 17, 2022 | By Order of the Board of Directors |

| Brooklyn, New York | Paul J Wyckoff | |

| Interim Chief Financial Officer |

| 20 |