UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant | ☒ |

| Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Rule14a-12 |

CEMTREX INC

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 240.0-11 and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| 1) | Amount Previously Paid: | |

| 2) | Form, Schedule or Registration Statement No.: | |

| 3) | Filing Party: | |

| 4) | Date Filed: |

CEMTREX, INC.

NOTICE OF SPECIAL MEETING OF SERIES 1 PREFERRED STOCK SHAREHOLDERS

Tuesday, December 26, 2023

To the Shareholders of CEMTREX, INC.:

NOTICE IS HEREBY GIVEN that a Special Meeting of Series 1 Preferred Stock Shareholders (the “Special Meeting”) of CEMTREX, INC., a Delaware corporation (the “Company”), will be held at the Hyatt Regency Long Island, 1717 Motor Parkway, Hauppauge, NY 11788, on Tuesday, December 26, 2023, at 9:30 a.m. Eastern Daylight Time, or at any adjournment thereof, for the following purposes:

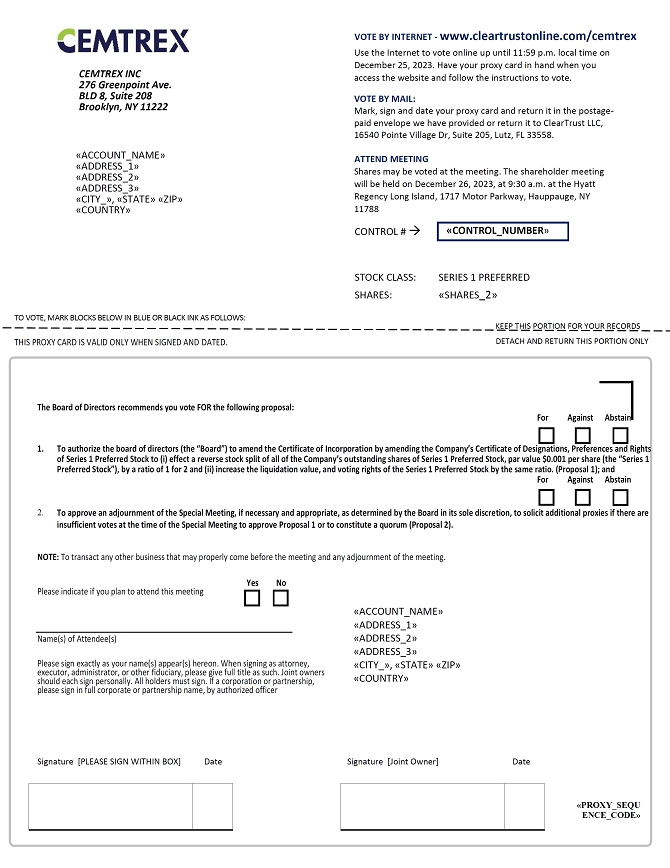

1. To authorize the board of directors (the “Board”) to amend the Certificate of Incorporation by amending the Company’s Certificate of Designations, Preferences and Rights of Series 1 Preferred Stock to (i) effect a reverse stock split of all of the Company’s outstanding shares of Series 1 Preferred Stock, par value $0.001 per share (the “Series 1 Preferred Stock”), by a ratio of 1 for 2 and (ii) increase the liquidation value, and voting rights of the Series 1 Preferred Stock by the same ratio. (Proposal 1); and

2. To approve an adjournment of the Special Meeting, if necessary and appropriate, as determined by the Board in its sole discretion, to solicit additional proxies if there are insufficient votes at the time of the Special Meeting to approve Proposal 1 or to constitute a quorum (Proposal 2).

The above matters are set forth in the Proxy Statement attached to this Notice to which your attention is directed.

Only shareholders of record of the Series 1 Preferred Stock on the books of the Company at the close of business on October 27, 2023, will be entitled to vote at the Special Meeting or at any adjournment thereof. You are requested to sign, date and return the enclosed Proxy at your earliest convenience in order that your shares may be voted for you as specified.

| By Order of the Board of Directors, | |

| Paul J. Wyckoff | |

| Interim Chief Financial Officer, Cemtrex, Inc. |

Important Notice Regarding Internet Availability of Proxy Materials

for the Special Meeting to Be Held on Tuesday, December 26, 2023:

The proxy materials for the Special Meeting, including the Annual Report

and the Proxy Statement, are available at cleartrustonline.com/cemtrex.

| Dated: | November 9, 2023 | |

| Hauppauge, New York |

| 2 |

CEMTREX INC.

135 Fell Court

Hauppauge, NY 11788

PROXY STATEMENT

SPECIAL MEETING OF SERIES 1 PREFERRED STOCK SHAREHOLDERS

Tuesday, December 26, 2023

A Special Meeting of Series 1 Preferred Stock Shareholders (the “Special Meeting”) of CEMTREX INC. (the “Company”) will be held on Tuesday, December 26, 2023, at the Hyatt Regency Long Island, 1717 Motor Parkway, Hauppauge, NY 11788, at 9:30 a.m. Eastern Daylight Time for the purposes set forth in the accompanying Notice of Special Meeting of Series 1 Preferred Stock Shareholders. The enclosed Proxy is solicited by and on behalf of the Board of Directors of the Company (“Board of Directors” or “Board”) for use at the Special Meeting to be held on Tuesday, December 26, 2023, and at any adjournments of such Meeting. The approximate date on which this Proxy Statement and the enclosed Proxy are being first mailed to shareholders is November 16, 2023.

If a Proxy in the accompanying form is duly executed and returned, the shares represented by such Proxy will be voted as specified. In the absence of such directions, the Proxy will be voted in accordance with the recommendations of management. Any person executing a Proxy may revoke it prior to its exercise either by letter directed to the Company or in person at the Special Meeting.

Proposals to be Voted on at the Special Meeting

The following matters are scheduled to be voted on at the Special Meeting:

1. To authorize the Board to amend the Certificate of Incorporation by amending the Company’s Certificate of Designations, Preferences and Rights of Series 1 Preferred Stock to (i) effect a reverse stock split of all of the Company’s outstanding shares of Series 1 Preferred Stock, par value $0.001 per share (the “Series 1 Preferred Stock”), by a ratio of 1 for 2 and (ii) increase the liquidation value, and voting rights of the Series 1 Preferred Stock by the same ratio. (Proposal 1); and

2. To approve an adjournment of the Special Meeting, if necessary and appropriate, as determined by the Board in its sole discretion, to solicit additional proxies if there are insufficient votes at the time of the Special Meeting to approve Proposal 1 or to constitute a quorum (Proposal 2).

No cumulative voting rights are authorized, and appraisal or dissenters’ rights are not applicable to these Proposals.

Voting Rights of the Series 1 Preferred Stock

Only the shares of Series 1 Preferred Stock will be voted at the Special Meeting of the Series 1 Preferred Stock. Pursuant to the Certificate of Designation for the Series 1 Preferred Stock, holders of the Series 1 Preferred shall vote as a class on any amendment altering or changing the powers, preferences or special rights of the Series 1 Preferred so as to affect them adversely. Each share of Series 1 Preferred held on the Record Date shall be entitled to one vote per share. No other voting securities of the company will participate at the Special Meeting.

Can I vote if my shares are held in “street name”?

If the shares you own are held in “street name” by a brokerage firm, your brokerage firm, as the record holder of your shares, is required to vote your shares according to your instructions. In order to vote your shares, you will need to follow the directions your brokerage firm provides you. Many brokers also offer the option of voting over the Internet or by telephone, instructions for which would be provided by your brokerage firm on your vote instruction form.

| 3 |

Will my shares be voted if I do not provide my proxy?

If you hold your shares directly in your own name, they will not be voted if you do not provide a proxy.

If your shares are held in street name, you must bring an account statement or letter from your bank or brokerage firm showing that you are the beneficial owner of the shares as of the Record Date in order to be admitted to the Special Meeting. To be able to vote your shares held in street name at the Special, you will need to obtain a proxy card from the holder of record.

Can I change my mind after I vote?

Yes, you may revoke your proxy and change your vote at any time before the polls close at the Special Meeting. You can do this by (1) signing another proxy with a later date and returning it to us prior to the Special Meeting, or (2) voting again at the Special Meeting.

What if I return my proxy card but do not include voting instructions?

Proxy cards that are signed and returned but do not include voting instructions will be voted in favor of Proposal 1 and, if necessary, Proposal 2.

How will votes be counted?

Each share of Series 1 Preferred Stock will be counted as one vote according to the instructions contained on a proper proxy card, whether submitted in person, by mail, on a ballot voted in person at the meeting or in accordance with the instructions provided by your broker. With respect to all proposals, shares will not be voted in favor of the matter and will not be counted as voting on the matter, if they are broker non-votes. Assuming the presence of a quorum, abstentions and broker non-votes for a particular proposal will not be counted as votes cast to determine the outcome of a particular proposal.

Will my vote be kept confidential?

Yes, your vote will be kept confidential, and we will not disclose your vote, unless we are required to do so by law (including in connection with the pursuit or defense of a legal or administrative action or proceeding). The inspector of elections will forward any written comments that you make on the proxy card to management without providing your name unless you expressly request disclosure on your proxy card.

How does the Board of Directors recommend that I vote on the proposals?

The Board of Directors recommends that you vote on the proxy card:

“FOR” amending the Company’s Certificate of Designations, Preferences and Rights of Series 1 Preferred Stock to (i) effect a reverse stock split of all of the Company’s outstanding shares of Series 1 Preferred Stock, par value $0.001 per share (the “Series 1 Preferred Stock”), by a ratio of 1 for 2 and (ii) increase the liquidation value and voting rights of the Series 1 Preferred Stock by the same ratio;

And “FOR” approving an adjournment of the Special Meeting, if necessary and appropriate, as determined by the Board in its sole discretion, to solicit additional proxies if there are insufficient votes at the time of the Special Meeting to approve Proposal 1 or to constitute a quorum.

Where can I find the voting results?

We will report the voting results in a current report on Form 8-K within four business days after the end of the Special Meeting.

| 4 |

What are the costs of soliciting these proxies and who will pay?

We will bear the costs of mailing the proxy statement and solicitation of proxies. In addition to solicitations by mail, our directors, officers and regular employees may solicit proxies by telephone, email and personal communication. No additional remuneration will be paid to any director, officer or employee of the Company for such solicitation. We will request brokers, custodians and fiduciaries to forward proxy soliciting material to the owners of shares of our Series 1 Preferred Stock that they hold in their names. We will reimburse banks and brokers for their reasonable out-of-pocket expenses incurred in connection with the distribution of our proxy materials. To the extent necessary in order to assure sufficient representation, our officers and regular employees may request the return of proxies personally, by telephone or email. The extent to which this will be necessary depends entirely upon how promptly proxies are received, and shareholders are urged to send in their proxies without delay.

HOUSEHOLDING OF MEETING MATERIALS

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of our proxy statement and annual report to shareholders may have been sent to multiple shareholders in your household unless we have received contrary instructions from one or more shareholders. We will promptly deliver a separate copy of either document to you if you contact us at the following address or telephone number: Cemtrex, Inc., 135 Fell Court, Hauppauge, NY 11788, telephone: (631) 756-9116. If you want to receive separate copies of the proxy statement or annual report to shareholders in the future, or if you are receiving multiple copies and would like to receive only one copy per household, you should contact your bank, broker, or other nominee record holder, or you may contact us at the above address or telephone number.

Under the Delaware General Corporation Law, shareholders are not entitled to dissenters’ rights with respect to the proposals set forth in this Proxy Statement.

SECURITY OWNERSHIP

The following table sets forth certain information known to us with respect to the beneficial ownership of our voting securities as of October 27, 2023, by:

| ● | all persons who are beneficial owners of five percent (5%) or more of our common stock, Series 1 Preferred Stock and Series C Preferred Stock; | |

| ● | each of our directors; | |

| ● | each of our executive officers; and | |

| ● | all current directors and executive officers as a group. |

Except as otherwise indicated, and subject to applicable community property laws, the persons named in the table below have sole voting and investment power with respect to all shares held by them.

Beneficial ownership is determined in accordance with the rules of the SEC. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, securities subject to options held by that person that are currently exercisable or exercisable within 60 days of October 27, 2023, are deemed outstanding. Such shares, however, are not deemed as of October 27, 2023, outstanding for the purpose of computing the percentage ownership of any other person.

| 5 |

| Title of Class | Name and Address of Beneficial Owner | Title | Amount Owned | Percentage of Issued Common Stock (1) | Percentage of voting stock (2) | |||||||||||

| Common Stock | Saagar Govil | Chairman of the Board, | 125,436 | 12 | % | * | ||||||||||

| 276 Greenpoint Avenue, Suite 208 | Chief Executive Officer, | |||||||||||||||

| Brooklyn, NY 11222 | and President | |||||||||||||||

| Preferred Stock | Saagar Govil | Chairman of the Board, | 132,298 | -- | 1.6 | % | ||||||||||

| (Series 1) | 276 Greenpoint Avenue, Suite 208 | Chief Executive Officer, | ||||||||||||||

| Brooklyn, NY 11222 | and President | |||||||||||||||

| Preferred Stock | Saagar Govil | Chairman of the Board, | 50,000 | (3) | -- | 64.6 | % | |||||||||

| (Series C) | 276 Greenpoint Avenue, Suite 208 | Chief Executive Officer, | ||||||||||||||

| Brooklyn, NY 11222 | and President | |||||||||||||||

| Paul J. Wyckoff | Interim Chief Financial | -- | -- | * | ||||||||||||

| 276 Greenpoint Avenue, Suite 208 | Officer | |||||||||||||||

| Brooklyn, NY 11222 | ||||||||||||||||

| Brian Kwon | Director | -- | -- | * | ||||||||||||

| 276 Greenpoint Avenue, Suite 208 | ||||||||||||||||

| Brooklyn, NY 11222 | ||||||||||||||||

| Manpreet Singh | Director | -- | -- | * | ||||||||||||

| 276 Greenpoint Avenue, Suite 208 | ||||||||||||||||

| Brooklyn, NY 11222 | ||||||||||||||||

| Metodi Filipov | Director | -- | -- | * | ||||||||||||

| 276 Greenpoint Avenue, Suite 208 | ||||||||||||||||

| Brooklyn, NY 11222 | ||||||||||||||||

| All directors and executive officers | ||||||||||||||||

| as a group (3 persons) | 307,734 | (4) | 12 | % | 66.9 | % | ||||||||||

| * | Less than one percent of outstanding shares . |

| (1) | Except as otherwise noted herein, the percentage is determined on the basis of 1,045,783 shares of our Common Stock outstanding plus securities deemed outstanding pursuant to Rule 13d-3 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Under Rule 13d-3, a person is deemed to be a beneficial owner of any security owned by certain family members and any security of which that person has the right to acquire beneficial ownership within 60 days, including, without limitation, shares of our common stock subject to currently exercisable options. | |

| (2) | This percentage is based on the 1,045,783 shares of our Common Stock outstanding, 50,000 shares of Series C Preferred Stock outstanding, and the 2,343,953 shares of Series 1 Preferred Stock outstanding. | |

| (3) | Pursuant to the Certificate of Designation of the Series C Preferred Stock, each issued and outstanding share of Series C Preferred Stock are entitled to the number of votes per share equal to the result of (i) the total number of shares of Common Stock outstanding at the time of such vote multiplied by 10.01, and divided by (ii) the total number of shares of Series C Preferred Stock outstanding at the time of such vote, at each meeting of our shareholders with respect to any and all matters presented to our shareholders for their action or consideration, including the election of directors. | |

| (4) | Pursuant to the Certificate of Designation for the Series 1 Preferred Stock, each share of Series 1 Preferred Stock is entitled to two votes per share. |

***

| 6 |

PROPOSAL ONE

APPROVAL OF AN AMENDMENT TO EFFECT A REVERSE STOCK SPLIT OF OUR OUTSTANDING SHARES OF SERIES 1 PREFERRED STOCK BY A RATIO OF 1 FOR 2

We are seeking shareholder approval to amend the Certificate of Incorporation by amending the Company’s Certificate of Designations, Preferences and Rights of Series 1 Preferred Stock to (i) effect a reverse stock split of all of the Company’s outstanding shares of Series 1 Preferred Stock, par value $0.001 per share (the “Series 1 Preferred Stock”), by a ratio of 1 for 2 and (ii) increase the liquidation value, and voting rights of the Series 1 Preferred Stock by the same ratio. (the “Reverse Split”).

The Reverse Split will not change the number of authorized shares of Preferred Stock. The number of authorized but unissued shares of our Series 1 Preferred Stock will materially increase and will be available for reissuance by the Company.

The Board approved, and recommended seeking shareholder approval of the Reverse Split, on September 29, 2023. If this Reverse Split is approved by the Series 1 Preferred Stock shareholders, the Board will have the authority, in its sole discretion, without further action by the shareholders, to effect the Reverse Split. The Board’s decision as to whether and when to effect the Reverse Split, if approved by the shareholders, will be based on a number of factors, including prevailing market conditions, existing and expected trading prices for our Series 1 Preferred Stock, actual or forecasted results of operations, and the likely effect of such results on the market price of our Series 1 Preferred Stock.

The Reverse Split is not being proposed in response to any effort of which we are aware to accumulate our shares of Series 1 Preferred Stock or obtain control of the Company, nor is it a plan by management to recommend a series of similar actions to the Board or our shareholders.

There are certain risks associated with a reverse stock split, and we cannot accurately predict or assure the Reverse Split will produce or maintain the desired results (for more information on the risks see the section below entitled “Certain Risks Associated with a Reverse Stock Split”). The Board believes that the benefits to the Company outweighs the risks and recommends that you vote in favor of granting the Board the discretionary authority to effect the Reverse Split.

Reasons for the Reverse Stock Split

The Board believes that effecting the Reverse Split would increase the price of our Series 1 Preferred Stock which would, among other things, help us to:

| ☐ Meet certain listing requirements of the Nasdaq Capital Market; | |

| ☐ Appeal to a broader range of investors to generate greater interest in the Company; and | |

| ☐ Improve perception of our Series 1 Preferred Stock as an investment security. |

In evaluating the Reverse Split, the Board has considered and will continue to consider negative factors associated with reverse stock splits. These factors include the negative perception of reverse stock splits held by many investors, analysts and other stock market participants, including their awareness that the trading prices of the securities of some companies that have effected reverse stock splits have subsequently declined to pre-reverse stock split levels. In recommending the Reverse Split, the Board determined that it believes the potential benefits of the Reverse Split significantly outweighed these potential negative factors.

| 7 |

Meet Listing Requirements – Our Series 1 Preferred Stock is listed on the Nasdaq Capital Market under the symbol CETXP. On July 29, 2022, Cemtrex, Inc. (the “Company”) received a notification letter from the Listing Qualifications Department of The Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that, because the closing bid price for the Company’s Series 1 preferred stock listed on Nasdaq was below $1.00 for 30 consecutive trading days, the Company no longer met the minimum bid price requirement for continued listing on The Nasdaq Capital Market under Nasdaq Marketplace Rule 5550(a)(2), requiring a minimum bid price of $1.00 per share (the “Minimum Bid Price Requirement”). On January 26, 2023, the Company received a notification letter from the Listing Qualifications Department of Nasdaq notifying the Company that, it had been granted an additional 180 days or until July 24, 2023, to regain compliance with the Minimum Bid Price Requirement based on the Company meeting the continued listing requirement for market value of publicly held shares and all other applicable requirements for initial listing on the Capital Market with the exception of the bid price requirement, and the Company’s written notice of its intention to cure the deficiency during the second compliance period by effecting a reverse stock split, if necessary. On September 8, 2023, Cemtrex Inc. (the “Company”) received a letter from the Nasdaq Hearings Panel (“Panel”) informing the Company that the Panel has granted the Company a temporary exception to regain compliance with The Nasdaq Stock Market LLC’s (“Nasdaq” or the “Exchange”) Listing Rule 5555(a)(1) (the “Bid Price Rule”) by no later than January 19, 2024.

The Board is seeking authority to effect the Reverse Split with the primary intent of increasing the price of our Series 1 Preferred Stock to comply with Nasdaq’s Bid Price Rule. The Board believes that, in addition to increasing the price of our Series 1 Preferred Stock to meet the price criteria for continued listing on Nasdaq, the Reverse Split would also make our Series 1 Preferred Stock more attractive to a broader range of institutional and other investors. Accordingly, for these and other reasons discussed below, we believe that effecting the Reverse Split is in our and our stockholders’ best interests.

The Reverse Split could effectively increase the per-share trading price of our Series 1 Preferred Stock to enable us to regain compliance with the Bid Price Rule, maintain the listing of our Series 1 Preferred Stock on Nasdaq and avoid a delisting of our Series 1 Preferred Stock from Nasdaq in the future. By preserving our Nasdaq Capital Market listing, we will have greater flexibility to consider and possibly pursue a wide range of future financing options. We believe being listed on a national securities exchange like the Nasdaq Capital Market is valued highly by many investors, particularly institutional investors. A listing on a national securities exchange also has the potential to create better liquidity and reduce volatility for buying and selling shares of our stock, which benefits our current and future stockholders.

Appeal to a Broader Range of Investors to Generate Greater Investor Interest in the Company – An increase in our stock price may make our Series 1 Preferred Stock more attractive to investors. Brokerage firms may be reluctant to recommend lower-priced securities to their clients lower-priced securities. Many institutional investors have policies prohibiting them from holding lower-priced stocks in their portfolios, which reduces the number of potential purchasers of our Series 1 Preferred Stock. Investment funds may also be reluctant to invest in lower-priced stocks. Investors may also be dissuaded from purchasing lower-priced stocks because the brokerage commissions, as a percentage of the total transaction, tend to be higher for such stocks. Moreover, the analysts at many brokerage firms do not monitor the trading activity or otherwise provide coverage of lower-priced stocks. Giving the Board the ability to effect the Reverse Split, and thereby increase the price of our Series 1 Preferred Stock, would give the Board the ability to address these issues if it is deemed necessary.

Improve the Perception of Our Series 1 Preferred Stock as an Investment Security – The Board believes that effecting the Reverse Split is one potential means of increasing the share price of our Series 1 Preferred Stock to improve the perception of our Series 1 Preferred Stock as a viable investment security. Lower-priced stocks have a perception in the investment community as being risky and speculative, which may negatively impact not only the price of our Series 1 Preferred Stock, but also our market liquidity.

Certain Risks Associated with the Reverse Split

Even if a reverse stock split is effected, some or all of the expected benefits discussed above may not be realized or maintained. The market price of our Series 1 Preferred Stock will continue to be based, in part, on our performance and other factors unrelated to the number of shares outstanding. The Reverse Split will reduce the number of outstanding shares of our Series 1 Preferred Stock without reducing the number of shares of available but unissued Series 1 Preferred Stock, which will also have the effect of increasing the number of shares of Series 1 Preferred Stock available for issuance. The issuance of additional shares of our Series 1 Preferred Stock may have a dilutive effect on the ownership of existing shareholders. The current economic environment in which we operate, the debt we carry, along with otherwise volatile equity market conditions, could limit our ability to raise new equity capital in the future.

| 8 |

We cannot assure that the total market capitalization of our Series 1 Preferred Stock after the implementation of the Reverse Split will be equal to or greater than the total market capitalization before the Reverse Split or that the per-share market price of our Series 1 Preferred Stock following the Reverse Split will increase in proportion to the reduction in the number of shares of our Series 1 Preferred Stock outstanding in connection with the Reverse Split. Also, we cannot assure you that the Reverse Split would lead to a sustained increase in the trading price of our Series 1 Preferred Stock. The trading price of our Series 1 Preferred Stock may change due to a variety of other factors, including our ability to successfully accomplish our business goals, market conditions and the market perception of our business. You should also keep in mind that the implementation of the Reverse Split does not affect the actual or intrinsic value of our business or a stockholder’s proportional ownership in our company (subject to the treatment of fractional shares). If the overall value of our Series 1 Preferred Stock declines after the proposed Reverse Split, however, then the actual or intrinsic value of the shares of our Series 1 Preferred Stock will also proportionately decrease as a result of the overall decline in value.

Further, the Reverse Split may reduce the liquidity of our Series 1 Preferred Stock, given the reduced number of shares that would be outstanding after the Reverse Split, particularly if the expected increase in stock price as a result of the Reverse Split is not sustained. For instance, the proposed Reverse Split may increase the number of stockholders who own odd lots (fewer than 100 shares) of our Series 1 Preferred Stock, creating the potential for those stockholders to experience an increase in the cost of selling their shares and greater difficulty in selling those shares. If we effect the Reverse Split, the resulting per-share stock price may nevertheless fail to attract institutional investors and may not satisfy the investing guidelines of such investors and, consequently, the trading liquidity of our Series 1 Preferred Stock may not improve.

Although we expect the Reverse Split to result in an increase in the market price of our Series 1 Preferred Stock, the Reverse Split may not result in a permanent increase in the market price of our Series 1 Preferred Stock, which would depend on many factors, including general economic, market and industry conditions and other factors described from time to time in the reports we file with the SEC.

Effects of the Reverse Split

If our shareholders approve the proposed Reverse Split and the Board elects to effect the Reverse Split, our issued and outstanding shares of Series 1 Preferred Stock, for example, would decrease at a rate of approximately one (1) share of Series 1 Preferred Stock for every two (2) shares of Series 1 Preferred Stock currently outstanding in a one-for-two split. The Reverse Split would be effected simultaneously for all of our Series 1 Preferred Stock, and the exchange ratio would be the same for all shares of Series 1 Preferred Stock. The Reverse Split would affect all of our Series 1 Preferred Stock shareholders uniformly and would not affect any shareholders’ percentage ownership interests in the Company. The Reverse Split would not affect the relative voting or other rights that accompany the shares of our Series 1 Preferred Stock as the amendment would adjust the liquidation preference and voting rights by the same ratio. The Reverse Split would not affect our securities law reporting and disclosure obligations, and we would continue to be subject to the periodic reporting requirements of the Securities Exchange Act of 1934, as amended. We have no current plans to take the Company private. Accordingly, the Reverse Split is not related to a strategy to do so.

In addition to the change in the number of shares of Series 1 Preferred Stock outstanding, the Reverse Split would have the following effects:

Increase the Per Share Price of our Series 1 Preferred Stock - By effectively condensing a number of pre-split shares into one share of Series 1 Preferred Stock, the per share price of a post-split share is generally greater than the per share price of a pre-split share. The amount of the initial increase in per share price and the duration of such increase, however, is uncertain. The Board may utilize the Reverse Split as part of its plan to maintain the required minimum per share price of the Series 1 Preferred Stock under the Nasdaq listing standards.

After the effective time of the Reverse Split, our Series 1 Preferred Stock will have a new CUSIP number, which is a number used to identify our equity securities, and investors holding stock certificates with the older CUSIP number will need to exchange them for stock certificates with the new CUSIP numbers by following the procedures described below.

| 9 |

Our Series 1 Preferred Stock is currently registered under Section 12(b) of the Exchange Act, and we are subject to the periodic reporting and other requirements of the Exchange Act. The implementation of the Reverse Split will not affect the registration of our Series 1 Preferred Stock under the Exchange Act, and following the Reverse Split, we would continue to be subject to the periodic reporting requirements of the Exchange Act. Our Series 1 Preferred Stock would continue to be listed on the Nasdaq Capital Market under the symbol “CETXP” immediately following the Reverse Split, although it is likely that Nasdaq would add the letter “D” to the end of the trading symbol for a period of 20 trading days after the effective date of the Reverse Split to indicate that the Reverse Split had occurred.

Procedure for Effecting the Reverse Split

If our stockholders approve the Reverse Split and if the Board concludes that the Reverse Split is in the best interests of our company and our stockholders on a date no later than January 19, 2024, the Board would cause the Reverse Split to be implemented on a 1 for 2 basis. We would file the Certificate of Amendment to our Certificate of Designation for the Series 1 Preferred Stock with the Secretary of State of Delaware so that it becomes effective at the time the Board determines to be appropriate. The Board may delay effecting the Amendment without resoliciting stockholder approval to any time before January 19, 2024 (if at all). The Amendment would become effective on the date the Certificate of Amendment to our Certificate of Designation for the Series 1 Preferred Stock is filed with the Secretary of State of Delaware or at such later effective date and time as specified in the filing.

Any fractional shares will be rounded up to the next whole number.

Beneficial Holders of Series 1 Preferred Stock (shareholders who hold shares in street name)

Upon the implementation of the Reverse Split, we intend to treat shares of Series 1 Preferred Stock held by shareholders through a bank, broker, custodian or other nominee in the same manner as registered shareholders whose shares of Series 1 Preferred Stock are registered in their names. Banks, brokers, custodians or other nominees will be instructed to effectuate the Reverse Split for their beneficial holders holding our Series 1 Preferred Stock in street name. However, those banks, brokers, custodians or other nominees may have procedures different than those for registered shareholders for processing the Reverse Split. Shareholders who hold shares of our Series 1 Preferred Stock with a bank, broker, custodian or other nominee and have any questions in this regard are encouraged to contact their banks, brokers, custodians or other nominees.

Registered “Book-Entry” Holders of Series 1 Preferred Stock (shareholders that are registered on our transfer agent’s books and records but do not hold stock certificates)

Certain of our registered shareholders may hold some or all of their shares of our Series 1 Preferred Stock electronically in book-entry form with our transfer agent. These shareholders do not have stock certificates evidencing their ownership of our Series 1 Preferred Stock. They are, however, provided with statements identifying the number of shares of our Series 1 Preferred Stock registered in their accounts.

Shareholders who hold shares of our Series 1 Preferred Stock k electronically in book-entry form with our transfer agent will not need to take action to receive whole shares of post-Reverse Split common stock (the exchange will be automatic), subject to adjustment for treatment of fraction shares.

| 10 |

Holders of Certificated Series 1 Preferred Stock

Shareholders holding shares of our Series 1 Preferred Stock in certificated form will be sent a transmittal letter by the Company’s transfer agent after the Reverse Split is effective. The letter of transmittal will specify instructions regarding how a shareholder should surrender his, her or its certificate(s) representing our Series 1 Preferred Stock to our transfer agent in exchange for certificates representing the appropriate number of whole shares of post-Reverse Split Series 1 Preferred Stock. No new certificates will be issued to a shareholder until such shareholder has surrendered all old certificates, together with a properly completed and executed letter of transmittal, to our transfer agent. No shareholder will be required to pay a transfer or other fee to exchange his, her or its old certificate(s). Shareholders will then receive new certificates representing the number of whole Series 1 Preferred Stock that they are entitled to as a result of the Reverse Split, subject to the treatment of fractional shares. Until surrendered, the Company will deem outstanding old certificates held by shareholders to be cancelled and only represent the number of whole post-Reverse Split shares of our Series 1 Preferred Stock to which those shareholders are entitled, subject to such treatment of fractional shares. Any old certificates submitted for exchange, whether because of a sale, transfer or other disposition, will automatically be exchanged for new certificates. If an old certificate has a restrictive legend, the new certificate will be issued with the same restrictive legend.

The Board’s Recommendation

You may vote FOR or AGAINST or ABSTAIN from voting on Proposal 1. For Proposal 1 to be approved, we must receive a FOR vote from the holders of a majority of the votes represented by the outstanding shares of Series 1 Preferred Stock entitled to vote on the proposal. Abstentions and broker non-votes (if any) will have the effect of a vote AGAINST the proposal.

The Board unanimously recommends that you vote to approve the Reverse Split by voting FOR Proposal 1.

PROPOSAL 2

APPROVAL TO ADJOURN THE SPECIAL MEETING

General

Proposal 2 (the “Adjournment Proposal”) will be presented to stockholders at the Special Meeting to seek their approval of an adjournment to another time or place, if necessary or appropriate, to solicit additional proxies if there are not sufficient votes at the time of the Special Meeting to approve Proposal 1 or to constitute a quorum.

If, at the Special Meeting, the number of shares present or represented and voting to approve Proposal 1 is not sufficient to approve that proposal, or if a quorum is not present, the Board currently intends to move to adjourn the Special Meeting to enable the Board to solicit additional proxies for the approval of Proposal 1.

In this proposal, we are asking our stockholders to authorize the holder of any proxy solicited by the Board to vote in favor of granting discretionary authority to the Board to adjourn the Special Meeting to another time and place for the purpose of soliciting additional proxies. If the stockholders approve the Adjournment Proposal, the Board could adjourn the Special Meeting and any adjourned session of the Special Meeting and use the additional time to solicit additional proxies, including the solicitation of proxies from stockholders who have previously voted. If the stockholders do not approve the Adjournment Proposal, the Board will lack the authority to adjourn the Special Meeting that stockholder approval of the Adjournment Proposal would provide, but will retain authority to cancel or postpone the Special Meeting and reschedule a new special meeting of stockholders for a later date.

The Board’s Recommendation

For Proposal 2 to be approved, we must receive a FOR vote from the holders of a majority of all those outstanding shares that (a) are present or represented by proxy at the Special Meeting, and (b) are cast either affirmatively or negatively on the Proposal, whether or not a quorum is present. Abstentions and broker non-votes (if any) will not be counted FOR or AGAINST the proposal and will have no effect on the proposal.

The Board unanimously recommends that you vote FOR Proposal 2.

| 11 |